Stock markets reached record highs in August, and bonds also helped investors make money. This happened even though there were ongoing concerns about tariffs, Federal Reserve independence, and technology company stocks. The month started with new U.S. tariffs taking effect on most major trading partners after a 90-day waiting period ended. Later, a federal appeals court said these “reciprocal tariffs” were against the law, which might lead to the case going to the Supreme Court.

Markets dropped in the middle of the month because investors worried the Federal Reserve (the Fed) might keep interest rates high for a longer time to control inflation. Recent inflation reports, like the Producer Price Index, show that companies are starting to charge consumers more to cover the extra costs from tariffs. But market confidence came back quickly because companies reported better profits than expected and investors became more confident that the Fed would lower interest rates at their September meeting.

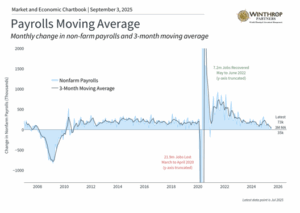

Economic data showed mixed results. GDP growth (which measures how fast the economy is growing) for the second quarter was revised up from 3.0% to 3.3%, much better than the first quarter’s 0.5% decline. However, the jobs report at the beginning of the month showed far fewer new jobs were created, and previous months’ numbers were also revised downward. This led the White House to fire the Commissioner of the Bureau of Labor Statistics, adding to the uncertain environment.

Even with these challenges, market volatility (how much prices move up and down) remains low compared to history. August’s strong performance in both stocks and bonds shows why investors should stay balanced and think long-term.

Key Market and Economic Numbers

- The S&P 500 (a measure of 500 large U.S. companies) rose 1.9% in August, the Dow Jones Industrial Average 3.2%, and the Nasdaq 1.6%. For the year so far, the S&P 500 is up 9.8%, the Dow is up 7.1%, and the Nasdaq is up 11.1%.

- The Bloomberg U.S. Aggregate Bond Index (a measure of the overall bond market) gained 1.2% in August. The 10-year Treasury yield (the interest rate on government bonds) ended the month lower at 4.2%.

- International developed markets jumped 4.1% in U.S. dollar terms using the MSCI EAFE index, while emerging markets gained 1.2% based on the MSCI EM index. For the year so far, the MSCI EAFE index has gained 20.4% and the MSCI EM index 17.0%.

- The U.S. dollar index ended the month lower at 97.8.

- Bitcoin fell in August, ending the month at 109,127 after experiencing a “flash crash” on August 24.

- Gold prices ended the month at a new all-time high of $3,487.

- The Consumer Price Index (a measure of inflation) rose 2.7% compared to the same time last year in July, matching what economists expected.

- The jobs report showed that the economy added only 73,000 jobs in July. Big downward changes to the May and June numbers mean that the job market was much weaker than first reported. The unemployment rate stayed low at 4.2%.

Stock markets rose because companies reported good profits

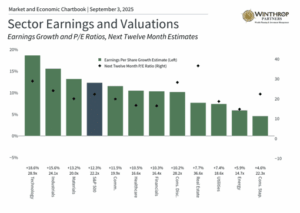

While daily news and headlines can move markets in the short term, basic business factors like company profits and stock prices compared to earnings are what really affect investment returns over time. Even though stock market valuations (how expensive stocks are) are quite high compared to history, this makes sense because companies continue to grow their profits at a good pace.

The latest earnings season (when companies report their quarterly profits) shows that 81% of S&P 500 companies did better than expected, according to FactSet. This is the highest percentage since the third quarter of 2023, showing that the economy and company fundamentals have been stronger than many people thought.1 This also shows how well companies can adapt as they deal with tariffs, handle higher costs, and find ways to grow despite policy uncertainty.

Many investors pay close attention to the earnings and returns of the Magnificent 7, a group of very large companies, including some worth multiple trillions of dollars. This group now makes up over one-third of the S&P 500, so how they perform can greatly affect the broader market. The earnings results were mixed for this group overall, but some of these “hyperscalers” (companies that can grow very quickly) did better than expected. Despite worries about an “AI bubble,” these results helped drive a market rally in the second half of August.

The Federal Reserve is expected to lower interest rates

On the other hand, businesses that sell directly to consumers reported mixed results because of changes in how households spend money. This problem gets worse with tariffs in place, as companies pass more of the tariff costs on to consumers. Combined with the weaker-than-expected jobs data, markets started expecting bigger interest rate cuts beginning in September.

Fed Chair Jerome Powell, in a speech at their yearly conference in Jackson Hole, Wyoming, gave the clearest sign yet that the central bank is ready to start cutting interest rates again after pausing this year. The Fed has a “dual mandate,” which means they try to keep inflation steady and unemployment low. Recently, they have kept interest rates relatively high because of stubborn inflation and a strong job market. So, early signs that the job market is getting weaker could push the Fed toward carefully cutting rates.

Fed rate cuts can create opportunities in different types of investments

The possibility of more Fed rate cuts could create opportunities in different types of investments. Besides supporting broad economic growth, lower interest rates can make it cheaper for companies to borrow money, reduce barriers for new projects, and increase the current value of future cash flows. For bonds, lower interest rates boost the prices of existing bonds that were issued when rates were higher.

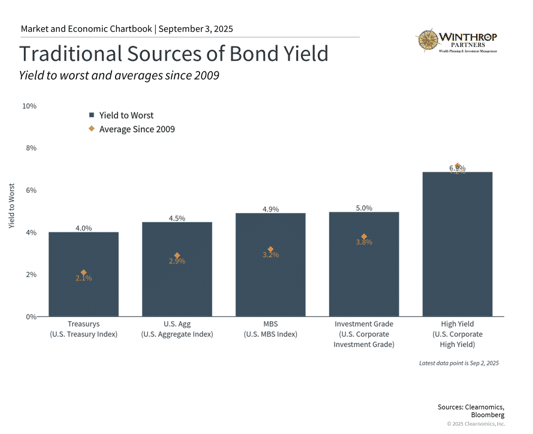

Bond yields (the interest payments bonds make) have stayed in a narrow range this year, with the 10-year Treasury yield generally moving between 4.0% and 4.5%. Even if short-term yields go down as the Fed cuts rates, many bond types are providing healthy levels of income. The U.S. aggregate bond index is yielding 4.4%, investment-grade corporate bonds 4.9%, and high-yield bonds 6.7%. These levels are well above historical averages and help support balanced portfolios.

For overall investment portfolios, investors should continue to focus on managing different sources of risk and return. Issues like tariffs, Fed policy, and the risk of a government shutdown in Washington are just some of the challenges that investors will face in the coming months. Rather than reacting to each event, holding a portfolio that can handle these ups and downs while providing both income and long-term growth is the best way to reach financial goals.

The bottom line? Markets reached new record highs in August despite many policy concerns. Strong company profits and economic growth continue to support portfolios despite ongoing uncertainty.

1.https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_082925.pdf

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Ryan Carney is a Partner at Winthrop Partners. With nearly 10 years of experience in financial services, Ryan began his career with Fidelity Investments and First Niagara Financial Group. In 2018 he was named by Buffalo Business First’s as a “30 under 30” honoree. He earned his B.S. in Economics from Bowdoin College and is a Certified Financial Planner.