“Life affords no greater responsibility, no greater privilege, than the raising of the next generation.” This quote from former United States Surgeon General C. Everett Koop highlights what many people see as their most important goal: creating a meaningful legacy that goes beyond their own financial needs.

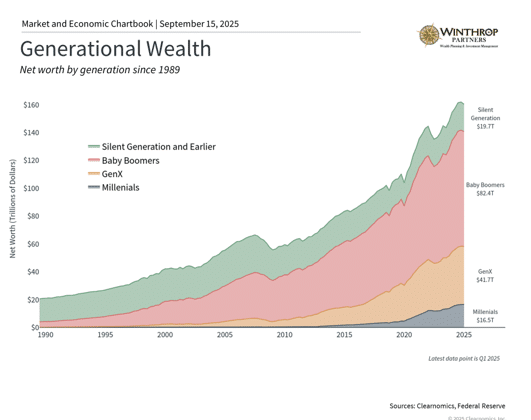

In the next twenty years, about $84 trillion will move from older Americans (the Silent Generation and Baby Boomers) to younger family members. Financial experts call this the Great Wealth Transfer.1 This change is about more than just money moving from one person to another – it’s already changing how families approach financial planning, giving to charity, and creating long-term legacies through careful planning.

For many people who invest, this wealth transfer brings both chances and duties. You might be getting ready to pass money to future generations, or you might expect to receive money from family members. Learning how to handle this change carefully can make the difference between keeping wealth in the family and seeing results that don’t match what the original owner wanted. The secret is taking a complete approach to moving wealth between generations.

Why this large movement of money matters

The amount and type of wealth being passed down has changed over recent decades. Unlike earlier generations who mostly relied on company pensions and Social Security, today’s retirees have built up large amounts of money in retirement accounts and investment portfolios. Baby Boomers, who are between 61 and 79 years old in 2025, now control over $82 trillion in wealth according to the Federal Reserve.

This growth in wealth happened for structural reasons. More people are living longer, financial markets performed well for an extended time, and there was a big shift from company pension plans to retirement plans like 401(k)s and individual retirement accounts (IRAs). While this change made individuals more responsible for saving for retirement, it also created larger pools of investment money that will eventually go to heirs. The outcome is that more families than ever before need to think carefully about wealth transfer planning.

Planning how you pass down wealth can create a lasting legacy

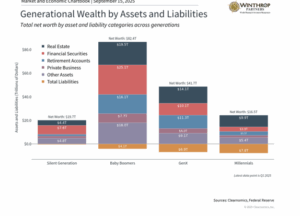

What makes this especially important is that these assets often represent decades of careful saving and investing. Today’s wealth transfers often include diversified investment portfolios (spread across different types of investments), multiple retirement accounts, and various tax-advantaged savings accounts. Along with inherited real estate or family businesses that previous generations might have passed down, each of these requires careful planning to ensure smooth transitions and the best tax treatment.

This means that estate planning (preparing for what happens to your money after you die) is more important than ever. While many people think of estate planning as just writing a will and related documents like a durable power of attorney and advance healthcare directives, thoughtful wealth transfer includes more than just deciding who gets what assets. By thinking about how your wealth can create meaningful impacts, reducing taxes, and managing complex structures, investors can create a lasting legacy.

It’s important to note that while everyone’s assets and legacy goals are different, the basic principles are similar. Just as Maslow’s hierarchy of needs helps us understand human motivation – where basic needs like food and shelter must be met before people can focus on higher goals – a similar pattern applies to wealth planning. Once you’ve saved enough for retirement to cover your basic needs, you can focus on creating meaningful impact with your wealth.

Remember that many wealth transfer problems come not from having too few assets, but from complex structures, unclear intentions, or heirs who aren’t prepared. A complete wealth transfer strategy should include values, expectations, and financial responsibility to ensure smoother transitions.

Ways to make wealth transfers work better

Looking at practical strategies, some of the most important decisions in making a wealth transfer work well involve timing and taxes. Here are just a few impactful strategies to consider:

- Tax-Smart Giving During Your Lifetime. Giving money away while you’re still alive isn’t right for everyone, since it requires confidence that you won’t need those assets for your own retirement, especially given rising healthcare costs and longer life expectancies.

That said, annual gift tax exclusions allow a person to transfer up to $19,000 per recipient in 2025 without reducing your lifetime estate tax exemption (the amount you can pass on without paying estate taxes). Lifetime giving can also provide practical benefits beyond tax savings. You can see how recipients handle the money, provide guidance on managing finances, and enjoy seeing the positive impact of your generosity.

For those interested in charitable giving, there can be significant tax advantages to contributing to a donor-advised fund (an account set up specifically for charitable giving), and involving family members in charitable decisions can help pass down values along with wealth.

- Education Funding Across Generations. By investing in education, you can give young family members the tools and knowledge they need to build successful futures. This can be especially meaningful given that college costs have grown much faster than inflation over recent decades, so helping with these expenses can make a huge difference.

Unlike other gifts, payments made directly to schools for tuition don’t count against annual gift tax exclusions, making this an especially tax-efficient wealth transfer strategy. Additionally, contributions to 529 education savings plans (special accounts designed for education expenses) offer unique benefits for legacy planning, as you can contribute large amounts while keeping control over the account. 529s can be used for K-12 tuition, college, and even student loan payments.

For larger families with multiple grandchildren or great-grandchildren, education trusts (legal structures that hold money specifically for education) may also be considered. While education trusts can add complexity, they can also help ensure fair treatment across beneficiaries, supporting family members across generations and creating an enduring legacy.

- Strategic Placement of Different Investments. Asset location involves strategically placing investments within different account types – taxable accounts, tax-deferred accounts (like traditional IRAs), and tax-free accounts (like Roth IRAs) – to get the best results.

By thoughtfully considering your financial structures and matching certain assets to certain bequests, you can ensure you and your beneficiaries get the most out of your money. You can even use techniques such as tax-loss harvesting (selling investments at a loss to offset taxes on gains) to minimize any tax implications.

For example, if you have large unrealized capital gains (profits you haven’t taken yet by selling) in a taxable account, you have options to minimize the tax burden. This might include waiting until after death for the cost basis to “step up” (meaning heirs get the investment at its current value for tax purposes), or potentially deciding to gift that asset to charity over time. If done thoughtfully, gifting could provide the double benefit of upfront tax deductions along with not having to pay tax on that gain.

- Advanced Estate Planning Techniques. As wealth transfer amounts increase and tax implications become more complex, advanced estate planning techniques can also become beneficial.

This might involve trusts (legal structures that hold and distribute assets according to your wishes) that distribute assets over time, including specific provisions or charitable components that involve the next generation. The complexity of modern wealth transfer also extends to business interests, retirement account beneficiary designations, and coordination between different types of liquid (easily sold) and illiquid (harder to sell) assets.

All of these strategies require specific expertise to ensure optimal outcomes and avoid unintended consequences. Yet, the opportunity to help future generations succeed has never been greater.

The bottom line? The Great Wealth Transfer represents a historic opportunity to create lasting impact across generations. Whether you’re preparing to transfer wealth or expecting to receive it, thoughtful planning can help ensure your family’s financial legacy serves its intended purposes.

- https://www.cerulli.com/press-releases/cerulli-anticipates-84-trillion-in-wealth-transfers-through-2045

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Ryan Carney is a Partner at Winthrop Partners. With nearly 10 years of experience in financial services, Ryan began his career with Fidelity Investments and First Niagara Financial Group. In 2018 he was named by Buffalo Business First’s as a “30 under 30” honoree. He earned his B.S. in Economics from Bowdoin College and is a Certified Financial Planner.