7 Powerful Insights into How Artificial Intelligence in Financial Markets Is Reshaping and What It Means for Long-Term Investors

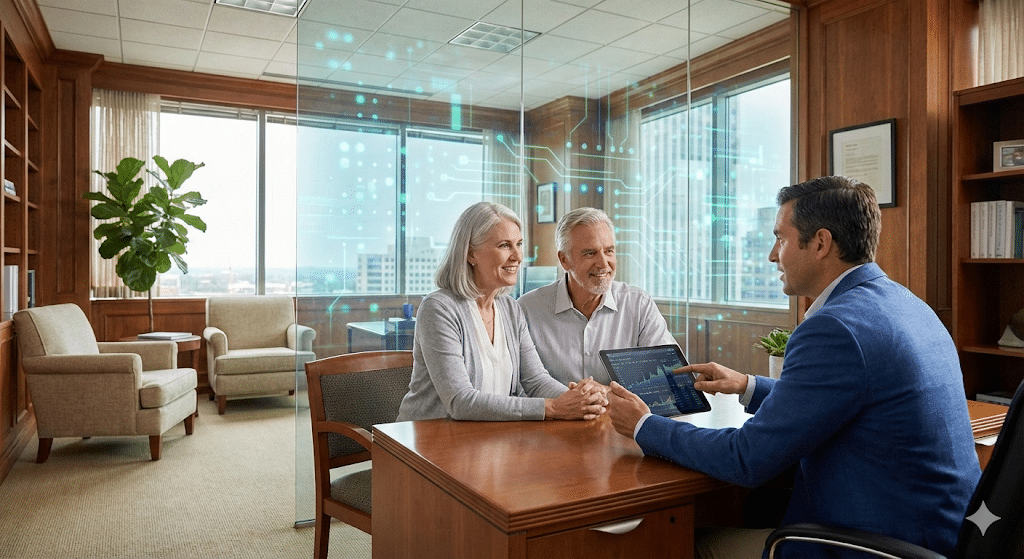

Artificial intelligence, or AI, in financial markets has been present for years, but the pace of change today feels different. Investors near or in retirement often ask whether these technologies will make markets harder to navigate or offer new opportunities for long-term planning. The truth sits somewhere in the middle. AI can help analysts and portfolio managers process information faster, yet it can also introduce new risks that deserve thoughtful attention.

If you’re investing for retirement or managing a portfolio intended to support you for decades, it helps to understand how AI works behind the scenes and how it may influence market behavior. The goal isn’t to predict markets. It’s to stay informed so you can make level-headed decisions with a disciplined strategy.

Understanding the Role of Artificial Intelligence in Today’s Financial Markets

AI shows up in more places than many investors realize. Many banks, asset managers, and trading firms use advanced software to evaluate data, flag irregularities, and estimate the probability of various outcomes. These tools don’t remove uncertainty, and they don’t replace human judgment. They do, however, give professionals a faster way to process the enormous amount of information that drives market activity.

For long-term investors, especially those working with advisors in Pittsburgh, Buffalo, or Doylestown, AI is best viewed as another tool in the market ecosystem. It may help explain why things move quickly at times and why certain sectors attract more attention than others.

Evolution of AI in Investment Strategies

AI isn’t new to Wall Street. What’s changed is the sophistication and availability of the technology.

- Early 2000s: Predominately rules-based algorithms. Systems followed strict instructions. If X happens, do Y. They couldn’t learn or adapt.

- 2010s: Increasing use of machine learning. Computers began analyzing patterns and adjusting based on new data.

- 2020s: More automated decision-support systems. Some platforms now evaluate market conditions and recommend actions with less manual intervention, although humans still oversee decisions.

- Understanding this evolution helps frame how quickly markets can react to headlines or shifts in economic data. Machines can process and react to information in microseconds, which primarily affects short term trading and intraday price moves, rather than long term fundamental.

How Machine Learning Models Analyze Market Behavior

Machine learning models digest vast amounts of information. They track prices, economic indicators, company reports, and alternative data. These models can identify correlations earlier than humans might.

That said, machine learning isn’t a crystal ball. Models learn from historical data, which means they can struggle when conditions shift in ways the data never captured. This is one of the reasons disciplined investors avoid relying on predictions. Instead, they focus on long-term goals and a steady investment management process that includes risk controls and periodic rebalancing.

Core Ways AI Is Reshaping the Market

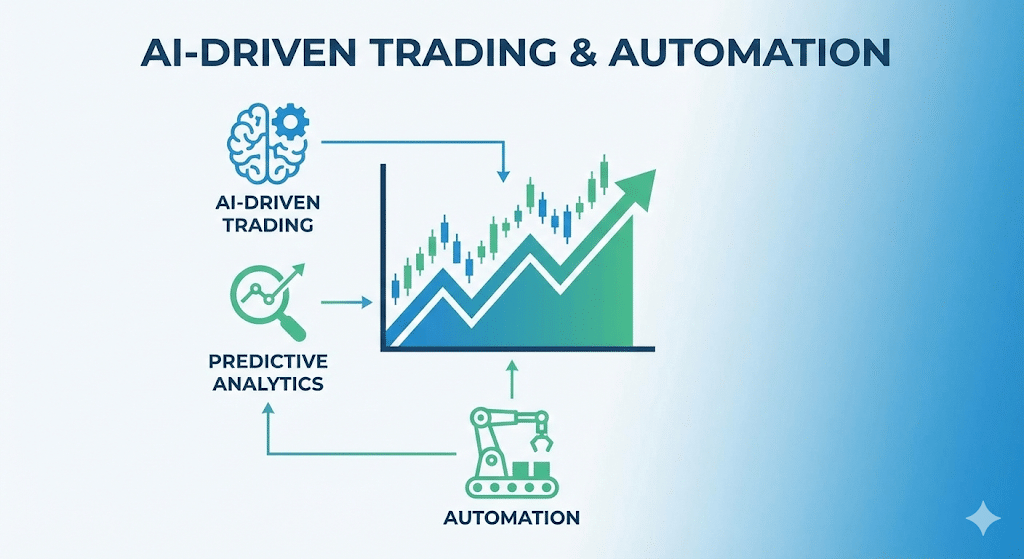

1. AI-Driven Trading Algorithms

Trading firms may use AI to scan markets and route orders with greater speed. These systems can react to news in milliseconds and may place thousands of small, rapid trades throughout the day. Their speed can create short spurts of volatility, especially when many systems respond to the same signal.

For individual investors, this activity often looks like noise. It may feel unsettling, but it rarely changes the trajectory of a long-term plan. A thoughtful retirement planning strategy helps ensure short-term movements don’t derail long-term goals.

2. Predictive Analytics in Stock Forecasting

Predictive analytics helps analysts estimate the likelihood of various outcomes by evaluating trends and assessing how historical factors have influenced prices. While valuable for research, these tools generate probabilistic estimates and should not be interpreted as definitive forecasts or guarantees.

Regulators such as SEC Investor.gov emphasize that no model can eliminate uncertainty or guarantee performance.

For retirees and those planning for retirement, predictive analytics may offer context, but it doesn’t replace diversified portfolio construction or sound financial planning.

3. Automation and Operational Efficiency

AI can minimize administrative errors, bolster compliance processes, and flag portfolios unusual portfolio activity. This can allow advisors to redirect their time toward higher-value activities such as planning, tax strategy, and direct client interaction.

For investors in Pittsburgh, Buffalo, and Doylestown, this means more time spent on the things that matter to you, like understanding cash flow needs and coordinating your retirement income strategy.

What It Means for Long-Term Investors

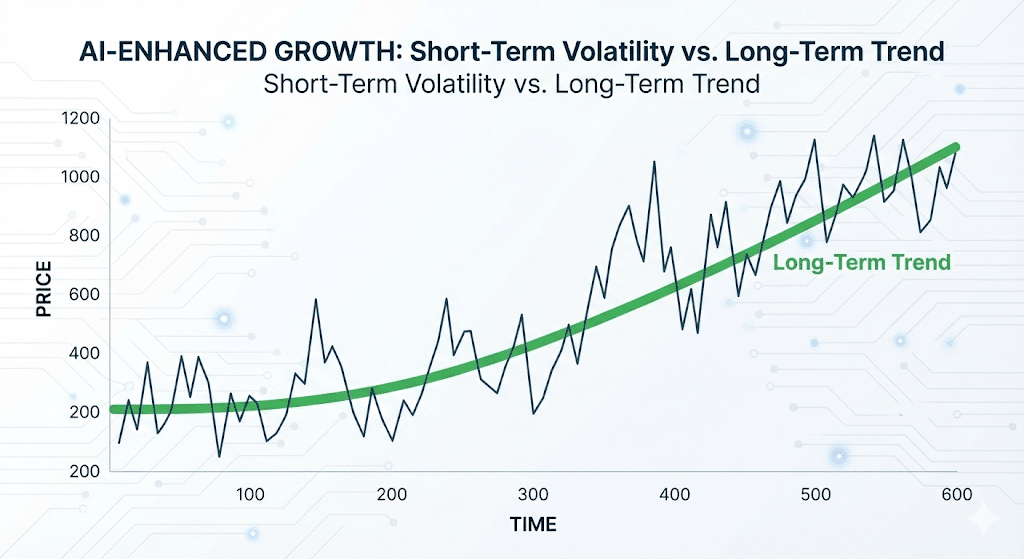

4. Market Volatility and AI-Driven Reactions

When machines respond to data quickly, markets can move sharply for short periods. These swings may feel new, but volatility has always been part of investing. A long-term plan helps keep perspective.

A long-term plan helps you stay grounded during fast movements. This is where working with a fiduciary advisor can make a meaningful difference. They help you focus on your goals rather than reacting to every short-term move.

5. Identifying AI-Enabled Growth Sectors

Certain sectors benefit directly from rising AI adoption. These may include:

- Cloud computing

- Semiconductors

- Cybersecurity

- Data infrastructure

- Specialized hardware and robotics

Exposure to these areas can be part of a diversified portfolio, although investors should avoid concentrating too heavily in any single theme. Broad diversification often matters more than chasing trends.

6. Challenges and Risks Investors Must Consider

AI brings benefits, but it also introduces real risks that deserve attention.

- Model errors. Algorithms can misinterpret data or fail in unfamiliar conditions.

- Data bias. If the underlying data is limited or skewed, the model may reinforce incorrect conclusions.

- Overreliance on automation. Investors who rely solely on model output may overlook risks that fall outside its scope.

- Regulatory uncertainty. Policymakers continue to evaluate how AI should be monitored in financial settings.

Understanding these risks can help investors maintain realistic expectations and avoid putting too much weight on any single tool or trend.

7. The Ongoing Role of Human Judgment

Even as AI continues to evolve, markets still depend on human insight. Professional advisors help investors weigh trade-offs, interpret risks, and design strategies that fit their goals and time horizons. Technology may assist with data analysis, but it can’t replace conversations about retirement income, taxes, or personal priorities.

If you’re thinking about how AI may affect your long-term plan, it may help to review your allocation, risk tolerance, and time horizon with a fiduciary advisor who understands both the technology and your personal goals.

You can schedule a consultation with our team if you’d like to talk through your situation.

FAQs

1. Is artificial intelligence making financial markets more volatile?

Under certain conditions, AI can accelerate short-term volatility because systems react quickly to new information. Long-term fundamentals are still driven by the underlying economy and company performance.

2. Will AI replace human financial advisors and investors?

It’s unlikely. AI can process data quickly, but human judgment remains essential for understanding personal goals, evaluating trade-offs, and making thoughtful decisions about retirement income, taxes, and risk.

3. Should long-term investors worry about AI-driven trading algorithms?

Most AI-driven activity happens at high speeds and tends to influence short-term trading more than long-term investment outcomes. A diversified portfolio and a clear plan generally matter more than day-to-day market noise.

4. How can retirees adjust their portfolios for AI-related changes in the market?

Periodic reviews with an advisor can help confirm diversification, align risk with your time horizon, and update your retirement income strategy as markets and technology evolve.

5: How should investors in Pittsburgh, Buffalo, and Doylestown think about AI in their portfolios?

Periodic reviews with an advisor can help confirm diversification, align risk with your time horizon, and update your retirement income strategy as markets and technology evolve.

Conclusion

Artificial intelligence is reshaping parts of the market, but it isn’t rewriting the fundamentals of long-term investing. It may influence short-term volatility and create new opportunities, yet lasting progress still depends on economic growth, company performance, and disciplined planning.

For investors in Pittsburgh, Buffalo, and Doylestown, the best approach is the one that has worked for decades. Stay diversified, stay patient, and keep your plan aligned with your goals. If you’d like to review how AI fits into your broader retirement or investment strategy, our team is here to help.

You can explore more insights on retirement and investing in our blog.

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Brian Werner is a Managing Partner at Winthrop Partners. He has more than 25 years of experience in investments, financial planning, entrepreneurial ventures, corporate finance, and banking. Prior to joining Winthrop Partners, Brian was the First Vice President and a Senior Wealth Advisor for First Niagara, where he led the development of First Niagara’s Western Pennsylvania Private Client Services and served on its western Pennsylvania operating committee. He also held roles with PNC/National City, Greycourt Investment Advisors, and Linnco Future Group, Chicago Board of Trade. Brian is a Chartered Financial Analyst and Certified Financial Planner. He earned his MBA from Duquesne University, Magna Cum Laude.