Stock markets bounced back in May, with the S&P 500 making up for its earlier losses this year. This good month happened even though there were new trade deals, mixed economic news, and worries about how much money the U.S. government owes. Many reports showed the economy is doing well, but everyday people still felt worried about what might happen next. Interest rates on government bonds went up and down during the month because of concerns about government spending and debt. For people investing for the long term, May shows that markets can adjust to changes, even when there’s a lot of uncertainty about the economy and government policies.

What Moved Markets and the Economy

1

- The S&P 500 (a measure of 500 large U.S. companies) went up 6.2% in May, its best month since 2023. The Dow Jones Industrial Average rose 3.9%, and the Nasdaq climbed 9.6%. For the whole year so far, the S&P 500 is up 0.5%, the Dow is down 0.6%, and the Nasdaq is down 1.0%.

- The Bloomberg U.S. Aggregate Bond index (which tracks many types of bonds) fell 0.7% in May but is up 2.4% for the year. The 10-year Treasury yield (the interest rate on 10-year government bonds) ended the month at 4.4%.

- International stocks also did well, with both developed and emerging market indexes rising 4.0%.

- The U.S. dollar index dropped to 99.3, close to a three-year low.

- Bitcoin reached a new record high of $111,092 before ending the month at $104,834.

- Gold also hit a new record high of $3,422 before closing at $3,288, up 24% for the year.

- The Consumer Price Index report showed that prices rose 2.3% in April compared to a year earlier, the smallest increase since February 2021.

- The economy added 177,000 new jobs in April while the unemployment rate stayed low at 4.2%.

Markets kept recovering despite new worries

May’s market bounce shows why it’s important to stick with your investment plan during rocky times. After a tough April, markets showed they could bounce back by recovering most of their losses and turning positive in May. This shows how quickly investor feelings can change when things start to get better, something investors have seen many times in the past ten years. Of course, what happened before doesn’t guarantee what will happen next, and markets will keep worrying about trade deals, U.S. debt, and the economy’s health in the coming months.

Credit rating agency cut the U.S. credit score

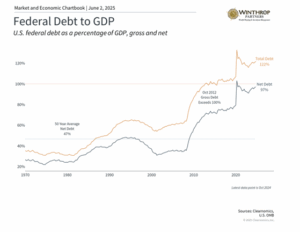

One of the biggest surprises in May was when Moody’s (a company that rates how likely governments are to pay back their debts) lowered the U.S. credit rating from Aaa to Aa1. This followed similar downgrades by other rating companies in 2023 and 2011, all because of worries about the country’s growing debt and spending. The chart shows that total U.S. debt grew to 122% of GDP (the total value of goods and services produced) in 2024. Net debt, which doesn’t include money the government owes itself, has risen to 97%.

Even though this U.S. debt downgrade was historic, markets barely reacted. This is because the downgrade mostly looks at what already happened, and investors already knew about the country’s money problems. The calm response also reflects lessons from the 2011 downgrade, when Treasury securities (government bonds) continued to be seen as safe investments.

It might not be a coincidence that this downgrade happened as the House of Representatives was passing a big tax and spending bill. The approved bill would extend individual tax cuts from an earlier law. This includes keeping the top tax rate at 37%, child tax credits, higher limits on state and local tax deductions, and no taxes on tips and overtime pay, among other things. According to experts at Penn Wharton, this law could increase deficits (when the government spends more than it takes in) by $2.8 trillion over the next 10 years.

2

The bill will now be discussed and possibly changed in the Senate.

While many would agree that these money problems need long-term solutions, the U.S. dollar is still the world’s main reserve currency and people will continue to want Treasury bonds for the foreseeable future.

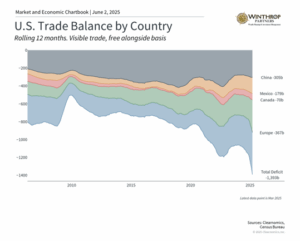

Trade talks made progress

There was also progress on trade talks in May, removing many of the worst possible outcomes. The administration reached deals with both the U.K. and China, while talks continued with other major trading partners. The U.S.-China trade agreement included a 90-day period of lower U.S. tariffs (extra charges on imported goods) on Chinese products.

Despite these deals, there will likely continue to be uncertainty around trade. More recently, China and the U.S. have both accused each other of breaking the trade truce, and the administration wants higher tariffs on steel and aluminum. At the same time, talks with the European Union created hope when the White House delayed its planned 50% EU tariff after positive discussions. This suggests that diplomatic solutions are still possible, even when starting positions seem very different.

The administration is also facing legal challenges to its tariffs. In May, the U.S. Court of International Trade struck down many of the newly created tariffs, ruling that they go beyond presidential power under a specific law. While a federal appeals court paused this ruling, allowing tariffs to stay in place for now, this legal challenge adds another layer of uncertainty to the trade situation.

It’s important to remember that trade policy usually takes months and years to unfold rather than days or weeks. The recovery in May reminds us that investors shouldn’t overreact to trade news, especially now that the worst-case scenarios are less likely to happen.

Steady company profits support the market

First quarter company earnings reports gave another reason for optimism. S&P 500 companies delivered better-than-expected earnings per share, and 64% reported higher-than-expected revenue, according to FactSet.

3

This strong earnings performance showed the underlying health of company profits, with technology companies showing strength as they deal with trade uncertainty.

In contrast, consumers have been pessimistic this year because of tariffs and inflation concerns. However, recent sentiment indicators began showing signs of improvement that match up better with positive earnings and economic data. The University of Michigan’s most recent survey for May showed inflation expectations going down slightly and sentiment stabilizing. While it’s important not to read too much into one month’s data, this improvement is an encouraging development. A strong economy and improving sentiment could help support markets.

The bottom line? May was a good month for investors. While the U.S. debt downgrade and fiscal concerns created new challenges, progress on trade deals helped boost markets. For long-term investors, these developments show the importance of keeping perspective and staying focused on basic trends rather than short-term policy headlines.

- Standard & Poor’s, Nasdaq, Bloomberg. All month end figures are as of May 30, 2025.

- https://budgetmodel.wharton.upenn.edu/issues/2025/5/23/house-reconciliation-bill-budget-economic-and-distributional-effects-may-22-2025

- FactSet Earnings Insight May 30, 2025

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Brian Werner is a Managing Partner at Winthrop Partners. He has more than 25 years of experience in investments, financial planning, entrepreneurial ventures, corporate finance, and banking. Prior to joining Winthrop Partners, Brian was the First Vice President and a Senior Wealth Advisor for First Niagara, where he led the development of First Niagara’s Western Pennsylvania Private Client Services and served on its western Pennsylvania operating committee. He also held roles with PNC/National City, Greycourt Investment Advisors, and Linnco Future Group, Chicago Board of Trade. Brian is a Chartered Financial Analyst and Certified Financial Planner. He earned his MBA from Duquesne University, Magna Cum Laude.