For over eighty years, Social Security has stood as a fundamental retirement scheme for American employees. Yet, with evolving demographics altering the country’s age makeup, concerns over the program’s future sustainability have surged. Although Social Security functions as a crucial income source in retirement, it forms just one part of a comprehensive financial strategy. Given the current economic and policy landscapes, appreciating how all retirement planning facets interact is vital for establishing enduring financial stability.

Regardless of how close you are to retirement—whether it’s years or decades away—gaining insight into Social Security’s role within your broader financial strategy is crucial. To make informed decisions about opportunities and potential risks, you need to grasp the program’s origins, current obstacles, and available approaches for managing future uncertainties.

Social Security’s historical foundation

Created in 1935 amid the Great Depression under President Franklin D. Roosevelt’s administration, Social Security emerged as a protective framework for America’s elderly population. The program has transformed from a modest benefit system serving a limited population into an extensive network supporting millions of retirees, disabled individuals, and their dependents. Currently, Social Security benefits constitute a substantial share of retirement income for countless Americans.

What obstacles does Social Security face in the present day? The program functions mainly through a pay-as-you-go structure, where current workers’ payroll contributions fund present-day benefits. Put simply, the payroll contributions you make today don’t accumulate for your future benefits but instead support today’s Social Security recipients.

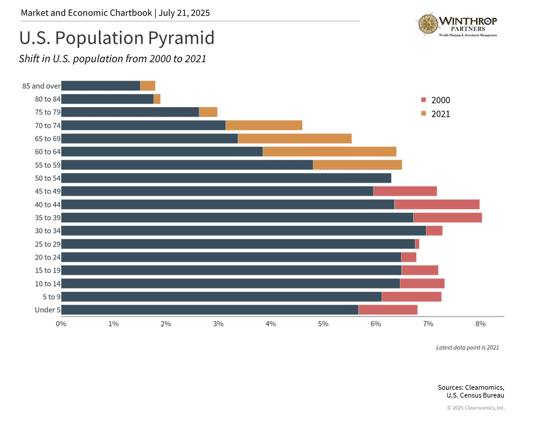

This approach functioned effectively when worker-to-beneficiary ratios remained favorable throughout most of the 20th century. Yet demographic changes have resulted in fewer contributors supporting the system while more retirees claim benefits. To illustrate, 1940 saw 42 workers supporting each retiree, but today that figure has dropped to approximately 2.8 workers per beneficiary. This ratio is expected to decrease further as aging populations expand and birth rates continue declining.

Various forecasts have emerged regarding Social Security trust fund depletion timelines. The most recent Social Security Board of Trustees projection indicates reserves will last until 2034, beyond which benefit reductions would become necessary. Currently, continuing payroll contributions would still support roughly 78% of scheduled benefits. Although precise timelines may vary, the fundamental issue persists: without significant reforms, trust funds may prove insufficient to maintain full scheduled benefits over time.

Increased longevity benefits individuals but strains Social Security funding

The national debt and deficit situation compounds concerns about program sustainability, with debt approaching $37 trillion alongside ongoing deficits. Despite Social Security’s “mandatory” classification, pressure to reduce government expenditures creates uncertainty about potential Congressional modifications to these programs.

Understandably, potential remedies face significant political disagreement, making immediate Social Security fixes improbable. Suggested approaches include adjusting retirement ages for benefit eligibility, expanding taxable wage limits, and enhancing fraud prevention measures. Regrettably, comprehensive long-term solutions for permanently resolving Social Security challenges remain scarce.

Examining other developed countries confronting similar demographic pressures can provide valuable insights. Multiple European nations, including France and the UK, have raised retirement ages to alleviate system pressures. Australia has adopted an alternative “means-tested” approach, providing benefits only to retirees meeting specific asset and income criteria.

Although the 2034 depletion timeline remains distant, the urgency for solutions will inevitably intensify. Complete benefit elimination appears highly improbable, yet Social Security’s ongoing funding difficulties will likely necessitate program adjustments.

Retirement Planning Strategic Approaches

Regarding individual actions, thoughtful planning becomes essential for maintaining retirement progress given Social Security uncertainties. Appropriate decisions depend on your comprehensive financial strategy, objectives, tax considerations, and additional factors.

Consider these key elements:

· Benefit Delay Decisions

While retirement benefits become available at age 62, early claiming reduces monthly payments. Alternatively, postponing benefits until age 70 can boost monthly payments by roughly 8% annually beyond full retirement age (66-67, based on birth year), per Social Security Administration guidelines.

Breakeven calculations can help evaluate whether delaying proves beneficial. Typically, living beyond your early 80s makes delayed benefits result in greater lifetime payments. However, this analysis shifts when considering money’s time value or opportunity costs.

· Bridging Approaches

Delaying benefits’ value depends significantly on interim income sources. Some retirees utilize portfolio distributions as a “bridge” toward enhanced Social Security benefits later. This approach can prove especially valuable for married couples, where maximizing the higher earner’s benefit establishes larger survivor benefits.

· Tax Considerations

Social Security benefits may be taxable up to 85%, depending on combined income levels. Future tax legislation could potentially raise this percentage. Strategic withdrawal planning with qualified advisor assistance can help reduce benefit tax impacts.

· Prudent Projections

Those earlier in their careers have additional time for retirement preparation and more options for addressing Social Security uncertainty.

Therefore, younger workers might consider developing retirement plans that don’t depend heavily on Social Security. This approach doesn’t mean completely disregarding it, but rather viewing potential benefits as supplementing personal savings instead of serving as the primary foundation.

· Monitor Policy Developments

Policy modifications will probably occur before trust fund depletion. Staying current on proposed reforms enables you to modify your planning appropriately. Potential changes include additional full retirement age increases, benefit formula adjustments, or payroll tax cap modifications.

· Optimize Tax-Advantaged Savings

Given Social Security’s uncertain future, maximizing 401(k), IRA, and HSA contributions becomes increasingly critical. These accounts offer tax benefits that can help offset potentially diminished government benefits.

Social Security’s Future Demands Thoughtful Planning

Despite valid concerns, maintaining proper perspective remains important. Social Security has encountered funding obstacles previously, and political motivation to maintain the program stays robust.

The sensible approach involves neither complete reliance on nor total dismissal of Social Security’s retirement planning role. Instead, investors should acknowledge the program’s significance while considering it as one element within a diversified retirement approach.

The bottom line? Understanding Social Security’s challenges enables you to construct a more robust retirement strategy, no matter your current age or professional stage.

Thomas Bunting is a Financial Advisor at Winthrop Partners. He has more than 50 years of experience in accounting, financial planning, and tax planning. Prior to joining Winthrop Partners, Tom held the roles of partner, managing partner, and senior partner with a mid-sized CPA firm that provided a full range of accounting, tax and financial planning services.

Tom is a member of the American Institute of Certified Public Accountants, the Personal Financial Planning and tax sections of the American Institute of Certified Accountants, and the Pennsylvania Institute of Certified Public Accountants. He was also a former member of the AICPA governing council and a past president of the PICPA. He earned his BS in Accounting from Temple University.