The markets in April experienced remarkable turbulence as investors processed new tariff announcements. Despite the S&P 500 experiencing a dramatic 12% decline at one point during the month, it recovered to finish within one percent of its opening level. Economic data revealed a slight contraction in the first quarter economy as businesses accumulated imported goods in anticipation of upcoming tariffs. While experiencing their own volatility, bonds and international equities provided positive contributions to diversified portfolios. This scenario reinforces the value of maintaining investment positions and diversification during uncertain periods.

Key Market and Economic Drivers

- The S&P 500 decreased 0.8% in April, the Dow Jones Industrial Average fell 3.2%, and the Nasdaq gained 0.9%. For the year so far, the S&P 500 has retreated 5.3%, the Dow 4.4%, and the Nasdaq 9.7%.

- The Bloomberg U.S. Aggregate Bond index advanced 0.4% in April and has gained 3.2% year-to-date. The 10-year Treasury yield concluded the month at 4.16%, fluctuating between 3.99% and 4.49% throughout the period.

- The U.S. dollar index decreased 4.5% to finish at 99.5, approaching a three-year low.

- Bitcoin dropped to $77,052 during the month, before recovering to $94,581 at month-end.

- The Consumer Price Index increased 2.4% in March year-over-year, below expectations and registering the lowest reading since September.

- Retail sales declined 0.9%, including a 1.9% reduction in nonstore retail sales (online shopping). The household savings rate increased slightly to 4.6% but remains under the historical average of 6.2%.

- The economy contracted with GDP falling 0.3% in the first quarter, marking the first decline since Q1 2022. A substantial increase in imports contributed significantly to this contraction.

Understanding market resilience during volatile periods

April reinforced the necessity of preparedness for market uncertainty. The month began with the White House’s April 2 announcement of tariffs affecting nearly all trading partners. These tariffs exceeded investor expectations, triggering concerns about inflation increases, global economic deceleration, and potential trade conflicts. Stock markets responded with the most severe declines witnessed since the pandemic era.

Market volatility surged during April

Investor sentiment improved when the administration announced a 90-day implementation pause for most countries just days later. Further exemptions on tariffs with China, particularly for technology products, additionally eased market tensions.

Despite significant market fluctuations throughout April, major indices closed with relatively modest changes. Diversified portfolios benefited from bond performance and strength in international equities. Consequently, while the S&P 500 has declined approximately 4.9% year-to-date including dividends, many balanced portfolios are nearly unchanged.

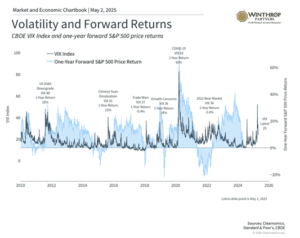

The chart illustrates how the VIX index, a prominent volatility indicator, briefly surpassed 50 for the first time since the pandemic. However, many substantial daily declines were followed by significant rebounds. This pattern demonstrates that market movements operate in both directions, and attempting to time these shifts often proves counterproductive.

Although markets have stabilized recently, uncertainty persists and many factors driving April’s volatility remain relevant. The trade policy situation continues to evolve, though the 90-day pause suggests worst-case scenarios may be less probable. Investors should anticipate that tariff developments could generate continued volatility in the near term, even as markets adjust to the evolving trade environment.

First quarter witnessed GDP contraction

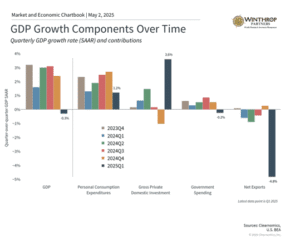

Investors remain particularly concerned about whether tariffs will accelerate inflation while hampering growth. Recent economic reports indicate the economy contracted slightly during the first quarter, with GDP declining 0.3%, marking the first contraction since early 2022. This decline stems almost exclusively from trade factors as businesses accelerated imports to build inventory. Consumer spending slowed but maintained positive territory. It’s worth noting that these figures represent initial GDP estimates and may undergo revisions.

As shown in the chart, consumer spending has driven economic growth significantly in recent years. Current surveys indicate consumers anticipate rapid price increases over both the coming year and longer term, resulting in historically depressed consumer confidence levels. While this hasn’t yet substantially affected consumer spending or inflation, it could become increasingly significant in upcoming months.

The complex interplay between economic growth and inflation complicates the Federal Reserve’s position. Beyond challenging interest rate decisions in coming months, the central bank’s independence was momentarily questioned by the White House, creating additional market uncertainty. Currently, markets anticipate approximately four Fed rate cuts this year, potentially beginning in July.

These developments also produced unusual bond market fluctuations, though prices ultimately finished near their starting points. The 10-year Treasury yield ended April at 4.16%, while corporate bond yields edged higher. Some investors expressed concern about potential flight from U.S. assets, particularly with the dollar falling to multi-year lows.

Long-term investment discipline historically yields rewards

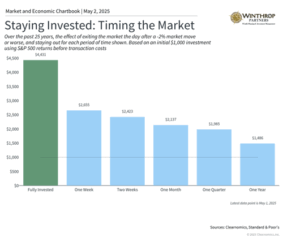

Amid recent challenges, one investment principle remains evident: maintaining investments through volatile periods has historically been crucial for long-term financial success. The accompanying chart demonstrates the potential consequences of attempting market timing following each 2% decline. Since positive and negative trading days often occur unpredictably, exiting the market after downturns, even briefly, can prove detrimental. The temptation to time markets may be particularly strong in the current economic environment.

While heightened volatility can create discomfort, these periods underscore the importance of focusing on financial planning, portfolio construction, and emerging opportunities. Market volatility frequently produces attractive valuations across numerous asset classes, creating potential opportunities for investors seeking greater diversification and portfolio balance. The S&P 500, for example, has experienced meaningful improvement in its price-to-earnings ratio this year.

The bottom line? April’s market volatility serves as a powerful reminder that short-term market fluctuations can occur without warning. Historical evidence consistently shows that disciplined investors who maintain focus on long-term financial strategies position themselves better for achieving their objectives.

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Brian Werner is a Managing Partner at Winthrop Partners. He has more than 25 years of experience in investments, financial planning, entrepreneurial ventures, corporate finance, and banking. Prior to joining Winthrop Partners, Brian was the First Vice President and a Senior Wealth Advisor for First Niagara, where he led the development of First Niagara’s Western Pennsylvania Private Client Services and served on its western Pennsylvania operating committee. He also held roles with PNC/National City, Greycourt Investment Advisors, and Linnco Future Group, Chicago Board of Trade. Brian is a Chartered Financial Analyst and Certified Financial Planner. He earned his MBA from Duquesne University, Magna Cum Laude.