On May 1, 2023, First Republic Bank was seized and further cracks in the banking system emerged. Since March of this year, the second, third, and fourth largest bank failures in American history have occurred.

Largest Bank Failures in U.S. History

| BANK | CITY | STATE | YEAR | ASSETS AT TIME OF FAILURE (Nominal) | ASSETS AT TIME OF FAILURE (Adjusted for Inflation, 2021) |

| Washington Mutual | Seattle | Washington | 2008 | $307 billion | $386 billion |

| First Republic Bank | San Francisco | California | 2023 | $229 billion | $229 billion |

| Silicon Valley Bank | Santa Clara | California | 2023 | $209 billion | $209 billion |

| Signature Bank | New York | New York | 2023 | $118 billion | $118 billion |

| Continental Illinois National Bank and Trust | Chicago | Illinois | 1984 | $40 billion | $104 billion |

CNBC Reported on 5-1-23 that some analysts and investors believe there are another twenty regional and midsized banks that could potentially be seized or forced to merge with healthier rivals. In fact, the I-Shares IAT regional bank ETF is down 28.19% YTD (through 5-2-23), signaling a great deal of distress in this sector. If you are thinking of investing in this sector, please contact us before doing so.

What Caused these Recent BANK Failures?

What caused these failures? Nothing new, it has always been a liquidity crisis (a “run”) when depositors withdraw their funds beyond the level of cash reserves the bank has on hand. Usually there is a spark that causes the run. In 2008 it was the quality of the credit (loans) on the books of many large banks. This year it appears to be the 2023 deflation of High Tech deposits that ballooned in the 2019-2022 period followed by:

- The Tech sector’s 2023 large withdrawals of these deposits to fund their flagging operations

- High levels of uninsured deposits (90% of Silicon Valley bank’s deposit base were in excess of FDIC Insurance limits)

- High concentrations of multimillion dollar depositors (Roku had $487,000,000 of cash deposited at Silicon Valley Bank). These large deposits are so-called “Hot Money” that will quickly transfer cash at the first sign of trouble.

- Recognition of portfolio losses when the bank posts collateral for loans. When banks face a sudden drain on deposits, they first borrow from the Federal Home Loan Bank. If they cannot raise sufficient funds at the FHLB, they then borrow from the Federal Reserve. Both institutions require collateral, usually high-grade government bonds. However, bond prices fall when interest rates rise, and in the 2022-23 period, interest rates rose at a record pace. Normally, this wouldn’t be a problem because the bank could hold the bond to maturity and avoid realizing the loss, but when it posts the bond as collateral it must mark the bond to market which created huge losses at these banks.

The confluence of these four factors created a run on the banks that caused their demise.

What should bank investors be wary of going forward?

Going forward, is there another risk that could negatively impact some of these weakened regional banks that have so far avoided a sustained cash crisis? Many analysts and investors like Charlie Munger at Berkshire Hathaway believe that risk may lie in certain banks’ real estate portfolios.

There are eight main subsectors withing the commercial real estate market including: multifamily, office, industrial, retail, hotels, mixed use, raw land and special purpose. A number of these sectors are under distress like office, retail, and industrial. While multifamily, hotels and mixed use are faring better.

Bricks and mortar retail has been decimated by e-commerce and former anchor tenants such as Sears, Bed Bath and Beyond, J.C. Penny, Toys ‘R Us, Kmart, Nieman Marcus, and J Crew along with hundreds of other retailers have either completely vacated their leases or have greatly reduced their footprint.

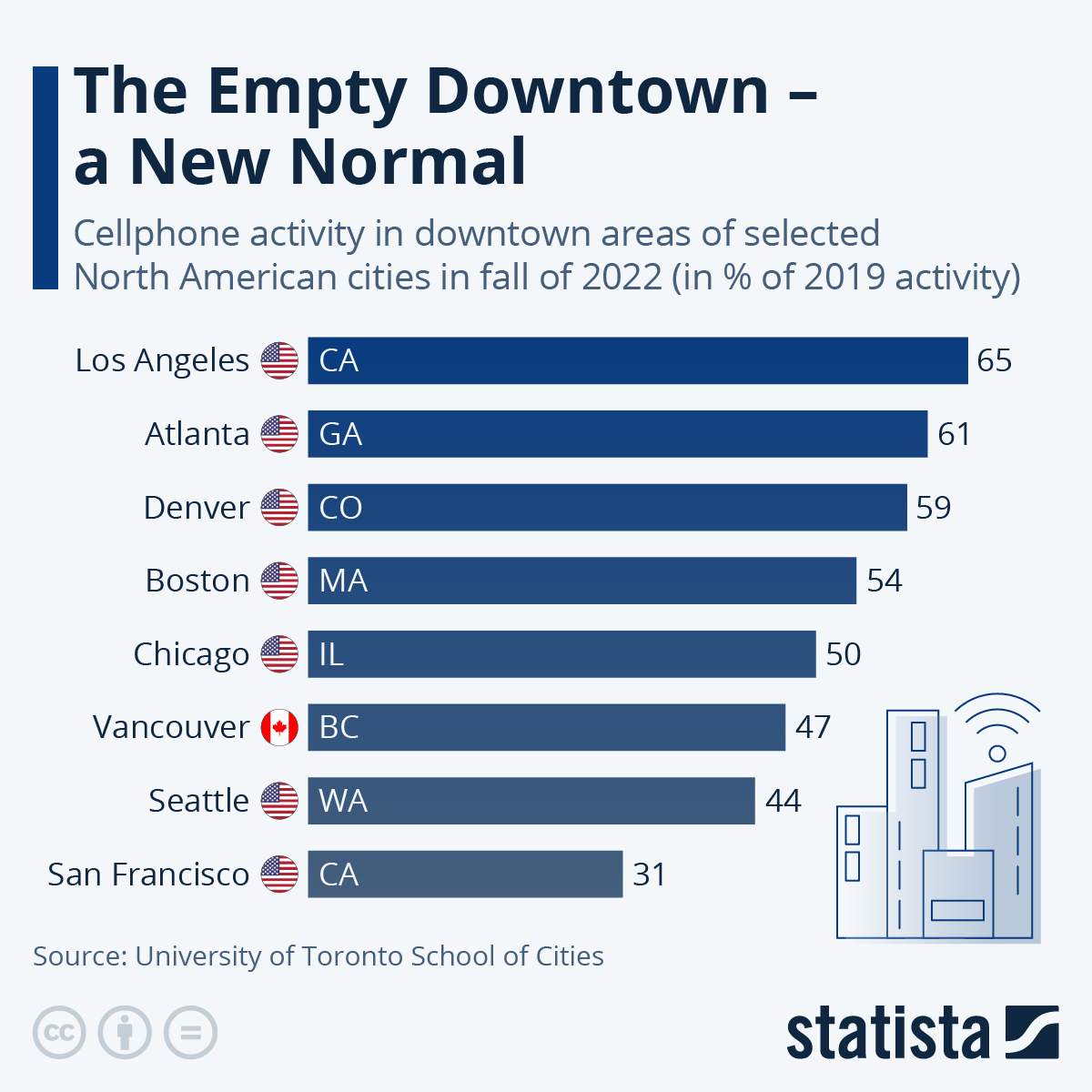

The office market, particularly in major cities, has been similarly decimated. The long-term nature of many leases and landlords’ use of incentives to register new leases and obscure the decline in their buildings’ value has made it easier for banks and landlords to extend loans, pretending there has been no diminution in the value of these assets. Perhaps the most interesting indicator of the decline in usage of inner-city office space is the decline in cell phone usage in these areas from 2019 to the fall of 2022; if there are no workers in the city centers it’s only a matter of time before the landlords begin to default.

Rising interest rates will further stress hundreds of billions of real estate loans held by regional and community banks. About 10% of real estate loans mature and roll-over each year. The replacement loans will carry interest rates which will average about 6% higher than their existing rates, further stressing these properties.

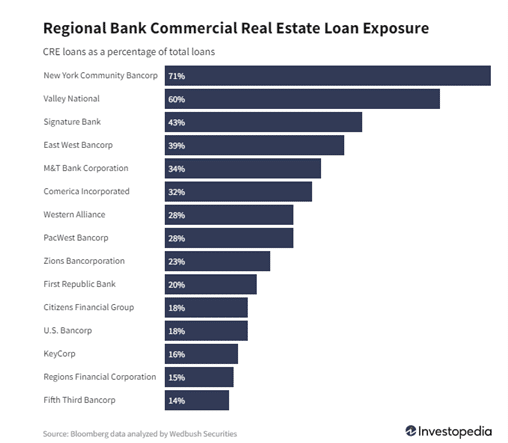

Banks with high levels of real estate exposure as of 4-6-23 include:

Many of these banks will weather the storm. Others will have trouble navigating the new high-rate environment as more customers default due to higher interest rates and vacancies, regulators taking a tougher stance, and most importantly, depositors, bondholders and investors becoming more skittish and prone to exit at the first sign of trouble. Contact us if you would like to better position all of your investments in light of rising interest rates.

Finally, what the Fed is ultimately trying to avoid is a 2008-style transition from isolated runs on banks as well as coordinated and sustained runs on banks and brokerages caused by depositors, investors and speculators ranking banks’ financial resilience, and then practically scheduling their demise.

Disclosures:

The views, opinions, and content presented are for informational purposes only. They are not intended to reflect a current or past recommendation; investment, legal, tax, or accounting advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. Nothing presented should be considered to be an offer to provide any product or service in any jurisdiction that would be unlawful under the securities laws of that jurisdiction. Past performance is not a guarantee of future results.

Thomas Saunders is the Managing Partner of Winthrop Partners. Prior to founding Winthrop Partners, Tom was Senior Vice President at what is now JP Morgan. His career includes senior and executive roles at Brown Brothers Harriman and First Niagara Bank, a top 25 Bank. Click here to contact Thomas Saunders about your investment and planning requirements.