Building a Bond Ladder: A Practical Guide for Steady Retirement Income

A bond ladder can be a useful way to create predictable income and add stability to a retirement portfolio. It works by spreading investments across bonds with different maturity dates so you have regular principal coming due over time. For many retirees in Pittsburgh, Buffalo, and Doylestown (Philadelphia area), a ladder can help balance income needs with the uncertainty of interest rate changes.

Below, we walk through how a bond ladder works, where it can be helpful, and what to consider as you build one.

What Is a Bond Ladder?

A bond ladder is simply a series of individual bonds that mature on different dates. Each maturity acts like a rung on a ladder. When a bond matures, you can use the principal for income or roll it into a new bond.

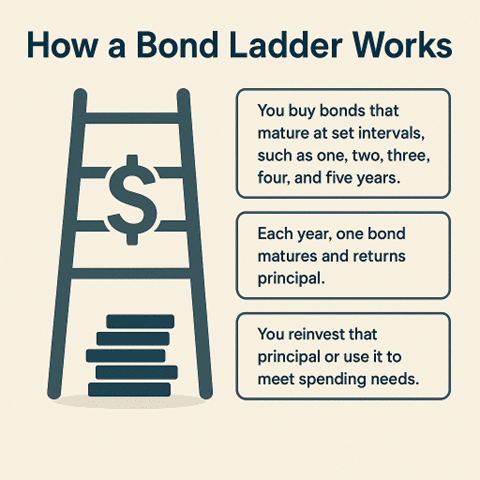

How It Typically Works

- Buy bonds that mature at intervals (e.g., 1, 2, 3, 4, and 5 years).

- Each year, one bond matures and returns principal.

- You reinvest that principal or use it to meet spending needs.

- Over time, this creates a steady rhythm of income and liquidity.

Core Terms

- Rungs: Each maturity date in the ladder.

- Coupon payments: Interest you receive from each bond.

- Principal return: The amount you get back at maturity.

Why Investors Use Bond Ladders

A well-structured bond ladder can help manage cash flow and interest rate changes.

Helps Smooth Interest Rate Changes

Because only one portion matures at a time, reinvestments happen gradually, reducing sensitivity to rate changes.

Creates a More Predictable Cash Flow Pattern

Many retirees value knowing when interest and principal arrive, especially when aligning spending and income.

Potential Advantages

- Built-in liquidity from annual maturities

- Diversification across issuers and maturities

Potential Limitations

- Reinvestment risk if future rates are lower

- Credit considerations if using corporate bonds

Key Principles of Building a Ladder

Choose Your Maturity Range

Many investors spread maturities across five, seven, or ten years.

Select Your Bond Types

· Treasuries: Backed by the U.S. government.

· Municipal bonds: May offer tax benefits (especially for high-income households)

Corporate bonds: Higher yields + higher credit risk

Step-by-Step: Designing Your Ladder

1. Determine Your Income Needs

Review expected expenses, guaranteed income sources, and any gap a ladder may help cover. Consider reviewing your broader financial plan with our team.

2. Select the Ladder Length

· Shorter ladders (3-5 years): More liquidity

· Longer ladders (7-10+ years): Potentially higher yields

Lear more about our retirement planning services. retirement planning services.

3. Blend Credit Quality

A mix of Treasuries, munis, and high-quality corporate bonds can help balance income and risk.

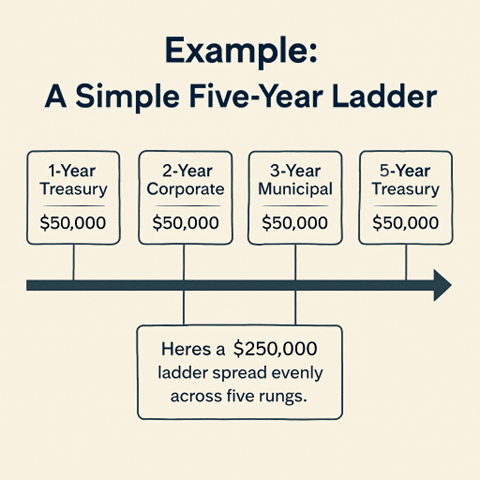

Example: A Simple Five-Year Ladder

For illustration only, here is a hypothetical $250,000 ladder spread evenly across five rungs:

· Year 1: $50,000 matures

· Year 2: $50,000

· Year 3: $50,000

· Year 4: $50,000

· Year 5: $50,000

When the first bond matures, the principal becomes available for income or reinvestment, and the ladder continues to roll forward.

Taxes and Account Placement

· Municipal bonds: Potential tax-free interest for investors in higher brackets

· Treasuries: State income tax exemptions

· Corporate bonds: Often best suited for tax-advantaged accounts

The ideal structure depends on your tax situation and retirement income strategy.

Bond Ladders vs. Bond Funds

Each serves a purpose:

Bond Ladders | Bond Funds |

Predictable maturity dates | No set maturity |

Control over individual holdings | Broad diversification |

Stable income stream | Easier management |

For many retirees, using both can provide complementary benefits.

Additional Approaches

Inflation-Focused Ladders

Treasury Inflation-Protected Securities (TIPS) can help preserve purchasing power during periods of rising prices.

Adjusting Maturities Over Time

If interest rates rise, some investors extend their ladders to lock in higher yields.

Different Structures

· Barbell: Mix of short- and long-term bonds

· Bullet: Rungs maturing in a specific target year (e.g., college funding)

Common Challenges to Avoid

· Relying too heavily on a single bond type or issuer

· Letting the ladder drift by not reinvesting principal as it matures

Helpful Resources

· U.S. Treasury: https://www.treasurydirect.gov

· SEC Investor Education: https://www.investor.gov

· Bond screeners at Fidelity, Vanguard, and Schwab

For broader retirement planning context, explore our blog for additional articles and resources.

If you’d like to talk through how a bond ladder may fit your goals, schedule a consultation with one of our advisors in Pittsburgh, Buffalo, or Doylestown.

FAQs About Bond Ladders

Is a bond ladder safe?

Safety depends on the credit quality of the bonds selected and your willingness to hold them to maturity.

How long should a ladder be?

Many investors choose between five and ten years, depending on income needs and comfort with rate changes.

Can you build a ladder with ETFs?

Yes. Target-maturity ETFs can offer a similar structure.

How often do you reinvest?

Typically each time a rung matures.

Are municipal bonds appropriate for ladders?

Yes, especially for higher-income investors who benefit from tax-free interest.

Do ladders help with inflation?

Traditional ladders provide partial protection. TIPS offer more inflation sensitivity.

Final Thoughts

A bond ladder can be a practical way to create predictable income and add stability to a retirement portfolio. The right structure depends on your goals, tax considerations, and comfort with interest rate changes.

If you’d like personalized guidance, our advisors in Pittsburgh, Buffalo, and Doylestown are available to help you build a retirement plan with clarity and confidence.

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Brian Werner is a Managing Partner at Winthrop Partners. He has more than 25 years of experience in investments, financial planning, entrepreneurial ventures, corporate finance, and banking. Prior to joining Winthrop Partners, Brian was the First Vice President and a Senior Wealth Advisor for First Niagara, where he led the development of First Niagara’s Western Pennsylvania Private Client Services and served on its western Pennsylvania operating committee. He also held roles with PNC/National City, Greycourt Investment Advisors, and Linnco Future Group, Chicago Board of Trade. Brian is a Chartered Financial Analyst and Certified Financial Planner. He earned his MBA from Duquesne University, Magna Cum Laude.