Consumer financial wellbeing serves as a crucial barometer for economic health. With consumer expenditures accounting for approximately 70% of total economic activity, consistent purchasing patterns have contributed significantly to better-than-expected economic growth in recent years. However, emerging signs of consumer weakness have sparked recession concerns among investors.

Media reports highlight increasing debt burdens and payment delinquencies amid inflation worries and growth slowdown fears. Simultaneously, economic data indicates robust consumer balance sheets, unprecedented household net worth levels, and sustainable monthly payment obligations. This apparent paradox has created confusion for investors trying to interpret these conflicting signals and determine if fundamental weaknesses are developing.

The explanation lies in what economists refer to as a “two-speed economy,” where financial circumstances differ markedly across consumer segments based on factors such as income, wealth, credit ratings, and other variables.

While financial difficulties affecting large portions of the population deserve serious attention, it’s essential to distinguish between impacts on individuals versus effects on financial markets and investment portfolios. Consumer health metrics should be evaluated alongside other indicators including savings rates, debt service ratios, and aggregate net worth. This comprehensive perspective helps explain why financial markets have demonstrated resilience despite these challenges.

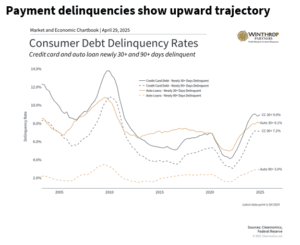

Payment delinquencies show upward trajectory

Among the most critical indicators of consumer financial stress are delinquency rates across various loan types. Delinquencies occur when borrowers miss payment deadlines, which can happen for numerous reasons. During the past two years, delinquencies for credit cards and auto loans have risen considerably, as illustrated in the chart above.

Delinquency tracking typically follows a progression based on days past due. Early-stage delinquency begins at 30 days late, with increasing severity at 60 and 90+ days. The emergence of new delinquencies is particularly significant because it identifies consumers who have recently begun experiencing payment difficulties. The increase in 90+ day credit card delinquencies suggests persistent financial challenges for certain consumer segments.

Auto loan delinquencies are especially revealing because consumers generally prioritize these payments even during financial hardship. This prioritization stems from the necessity of vehicles for commuting and maintaining daily activities. This pattern was particularly evident during the housing crisis when many homeowners faced “underwater” mortgages – situations where loan balances exceeded property values.

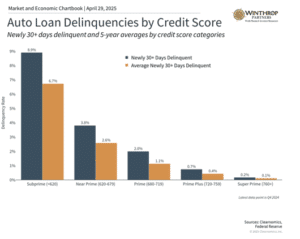

Credit quality significantly influences delinquency patterns

What accounts for increasing delinquencies and differences among loan categories? Recent analysis reveals these trends are primarily driven by variations in credit quality. Credit profiles typically range from subprime (borrowers with weaker credit histories) to prime (those with stronger credit records). Prime borrowers typically present lower default risk for lenders, while subprime loans generally carry higher interest rates reflecting elevated repayment uncertainty.

Current statistics indicate that rising auto loan delinquencies are concentrated predominantly among lower credit score borrowers. As shown in the chart, the delinquency rate disparity between subprime and prime borrowers is notable both in absolute terms and compared to historical averages. Similar patterns are evident in credit card delinquency statistics.

This distribution also explains why major financial institutions haven’t expressed broader concerns about consumer financial stability. During recent earnings discussions, banking executives highlighted the ongoing resilience of their consumer portfolios. This resilience persists despite tariff concerns, weak consumer sentiment, heightened inflation apprehensions, and other economic worries.

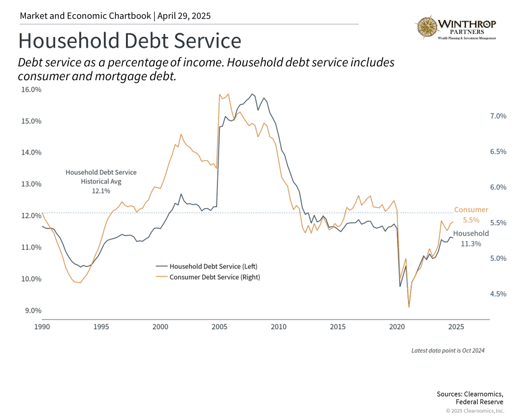

Debt service levels remain within sustainable parameters

Debt levels naturally tend to increase over time with economic expansion. To accurately assess consumer financial health, debt must be evaluated relative to income and savings. Currently, consumer debt payment obligations represent 5.5% of household income. While this ratio is approaching its long-term average, it remains historically low, indicating that average consumers are still managing their monthly obligations effectively.

Additionally, household savings rates have found stability in recent months, with Americans currently setting aside approximately 4.6% of their earnings, though this falls below the 6.2% historical average. Furthermore, U.S. household net worth continues near record highs despite market fluctuations and economic uncertainties in recent years. Together, these factors provide substantial support for the financial stability of many consumers.

It’s crucial to recognize that these aggregate measures can obscure significant variations across demographic and economic groups. The difficulties faced by subprime borrowers in this “two-speed economy” represent genuine and concerning developments. However, from macroeconomic and market perspectives, broader indicators of consumer finances remain healthy.

What are the implications for investors? Despite tariffs and market volatility contributing to inflation and recession concerns, broader consumer trends remain positive. This presents encouraging prospects for investors whose portfolios can withstand temporary market fluctuations as markets adjust to economic and policy uncertainties.

The bottom line? The two-speed economy clarifies why overall consumer metrics appear strong despite areas of financial distress. For investors, maintaining focus on longer-term trends supports staying invested to achieve financial objectives.

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Ryan Carney is a Partner at Winthrop Partners. With nearly 10 years of experience in financial services, Ryan began his career with Fidelity Investments and First Niagara Financial Group. In 2018 he was named by Buffalo Business First’s as a “30 under 30” honoree. He earned his B.S. in Economics from Bowdoin College and is a Certified Financial Planner.