Generally the clients that come to me ready to retire have done a nice job saving throughout their 30-40 year career. They’ve maximized their contributions, they’ve taken advantage of their employers’ contribution offerings, and they’ve even saved a little bit on the side. Unfortunately, although they’re prepared for retirement day, their lack of an appropriate allocation strategy puts them at risk for an unpredictable retirement journey.

To have an efficient investment portfolio that you can depend on in retirement requires many variables to be taken into account. The more you diversify your portfolio, the smoother ride you’ll have in your golden years. In this article, I’ll discuss the importance of creating a diversified portfolio and the best ways to set your portfolio up for long-term success.

Why is it important to diversify your portfolio?

A diversified portfolio contains various types of investments strategically designed to spread out risk, optimize the potential for steady returns, and create a long-term strategy that achieves financial goals over time. By investing in different asset classes, industries, geographic regions, and types of investments, your portfolio is more likely to weather the storms during times of high market volatility.

Ways to diversify your portfolio

A well-diversified portfolio includes a mix of these three main asset classes:

1. Stocks (equities)

Stocks are a type of security that gives stockholders a share of ownership in a company. Investors purchase stocks in companies that they think will increase in value over time. When the company does well, investors can earn money through dividends and increased value of stock over time.

Purchasing shares in a company carries more risk than other investments, but also holds the potential of reaping higher rewards long term. It’s good to consider diversifying the types of stocks you buy into as the likelihood of multiple companies doing poorly at the same time is less likely.

| Ways To Diversify Stocks |

|---|

| US vs. international markets |

| Large Cap vs. Mid Cap vs. Small Cap companies |

| Value-based vs. high growth companies |

| Technology vs. industrial companies |

| Real vs. digital assets (for example, atoms vs. bits) |

| Companies exposed to higher inflationary periods vs. dis-inflationary periods |

2. Bonds (Fixed-income)

Bonds are a fixed income instrument that represents a loan made by an investor to a government or a corporation. Considered less volatile than stocks, investors often include bonds in their portfolios to achieve a balanced mix of assets. Bonds help to manage risk in a portfolio, provide stability, and can typically provide a steady income.

| Ways To Diversify Bonds |

|---|

| Long-term vs. short-term bonds |

| Corporate vs. government bonds |

3. Cash and cash equivalents

Cash and cash equivalents can provide liquidity, portfolio stability, and emergency funds while typically having maturities of 3 months or less.

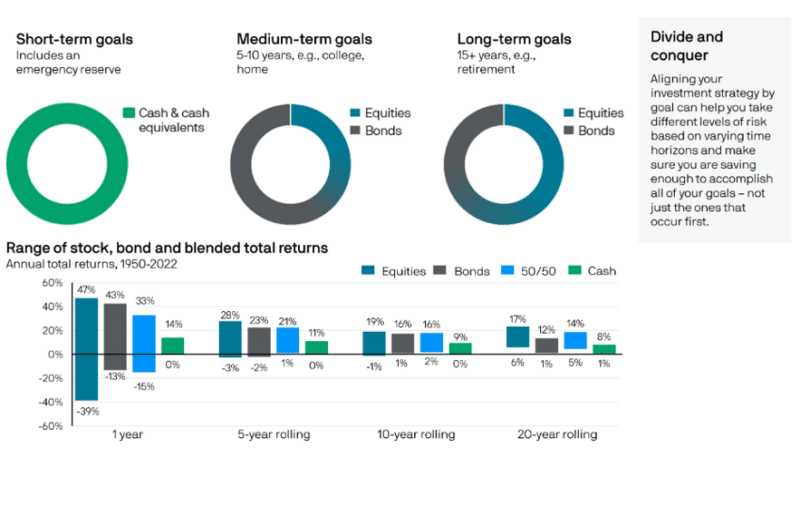

By strategically allocating to these three main asset classes, you’ll be able to have different levels of risk and return with each behaving differently over time. Asset allocation aims to balance risk and reward based on the investor’s goals, time horizon, and risk tolerance. Strategically allocating is essential to creating a balanced portfolio that’s best set to work for you in retirement.

When should I start diversifying my portfolio?

Though your portfolio diversification is an ongoing process that can change as new life circumstances arise, the sooner you start the process, the better off you’ll be. Ideally, within five years of your retirement date, you’ll want to sit down and really assess the ways your portfolio is going to work for you in retirement. With proper diversification in place, you’ll be in a more comfortable position and gain the confidence needed to handle any major market turndown you’ll face in the future.

Steps to creating a diversified portfolio with Winthrop Partners

1. Introductory meeting

This is the first and more important step you can take towards determining how to diversify your stocks and bonds. During this step we ask a lot of questions, make a lot of projections, and hit on key topics relevant to your unique circumstances. Together, we get a general idea of the money you’ve saved, the expenses you have, and the debt you’ve accumulated. Though you may have a sufficient amount saved, if you have any kind of debt, it could significantly factor into your future plans. Once you’ve decided on the lifestyle you want to live, the goals you want to achieve, and the expectations you have in your golden years, we can build the foundation of your portfolio.

Depending on where your money is allocated, whether it be in a 401k, IRA, or a Roth IRA, we determine the most advantageous ways to access and draw from your different sources of income throughout your retirement years.

At Winthrop Partners, we like to apply an effective matching strategy, also known as cash flow matching, to our portfolio diversification process. This is done after we’ve looked at the overall portfolio, see where the money for living expenses is going to come from within the portfolio, and determine hedging strategies to reduce the impact of the shortfalls. We then identify and accumulate short term investments such as bonds and bond funds, with payouts that will coincide with the individual’s cash requirements. This rolling strategy relies on the availability of securities with specific principal amounts, coupon payments, and maturities to work efficiently.

Goals-based wealth management

3. Create your investment allocation based on your risk tolerance

Using a risk assessment questionnaire, we establish a preliminary allocation of your assets according to your risk profile. We re-examine and then test over a thousand times to determine if the allocation works within your overall plan. Overtime, we monitor and adjust as necessary, pulling from certain baskets while allowing other baskets the opportunity to grow. This provides stability as well as overall asset allocation.

Another way you can track your long-term investments is to use our Smart Investing Calculator. It can offer a glimpse into how your initial investment, frequency of contributions, and expected rate of return can affect how your money grows.

Since these dynamic pieces are constantly evolving, it’s important that you have both your short and long-term investments working cohesively for you in retirement and that’s what gives our clients a real-peace-of-mind year in and year out.

How can a financial advisor help with the process?

An experienced advisor is the best person you can turn to when creating a diversified long-term portfolio. The right financial advisor will take the time to learn about you, deep-dive into your goals, and build a tailored plan specifically for what you value most. They’re aware that although most plans focus on a destination, many forget that the most important parts of the journey are the stops you take along the way. They’ll create a specialized plan that guides you through market cycles, life milestones, and equip you with all the tools you need to get there smoothly and with the most growth possible.

In conclusion

Even if you’re in retirement, it’s never too late to talk to somebody about structuring a kind of disciplined distribution strategy that can help your money work for you for the rest of your life.

At Winthrop Partners, we recognize that there is no clear-cut path to retirement and that everyone has their own unique circumstances that can unexpectedly reroute your planning. When designing and implementing a portfolio, there are plenty of variables that need to be considered. As a fee-only fiduciary, we take pride in helping you work through your options and assist in managing your choices. Whether you need help with retirement planning, investment management, or tax planning, we’re here to help you create a long term plan that works in your best interest.

To learn more about how Winthrop Partners can help you manage your retirement plan and diversify your portfolio, contact us today for your free consultation.

Disclosures:

The views, opinions, and content presented are for informational purposes only. They are not intended to reflect a current or past recommendation; investment, legal, tax, or accounting advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. Nothing presented should be considered to be an offer to provide any product or service in any jurisdiction that would be unlawful under the securities laws of that jurisdiction. All investments involve risk, including the possible loss of some or all of the principal amount invested. Past performance of a security or financial product does not guarantee future results. Investors should consider their investment objectives, risks, and risk tolerances carefully before investing. The Firm has made every attempt to ensure the accuracy and reliability of the information provided, but it cannot be guaranteed.

Brian Werner is a Managing Partner at Winthrop Partners. He has more than 25 years of experience in investments, financial planning, entrepreneurial ventures, corporate finance, and banking. Prior to joining Winthrop Partners, Brian was the First Vice President and a Senior Wealth Advisor for First Niagara, where he led the development of First Niagara’s Western Pennsylvania Private Client Services and served on its western Pennsylvania operating committee. He also held roles with PNC/National City, Greycourt Investment Advisors, and Linnco Future Group, Chicago Board of Trade. Brian is a Chartered Financial Analyst and Certified Financial Planner. He earned his MBA from Duquesne University, Magna Cum Laude.