Global attention has turned to escalating tensions between Israel and Iran, generating uncertainty across financial markets worldwide. Following Israeli military actions targeting Iranian nuclear and military installations that commenced on June 13, Iran responded with retaliatory strikes. Although the situation remains fluid and subject to rapid changes, emerging reports suggest Iran may consider ending hostilities and returning to nuclear program negotiations. These developments unfold against the backdrop of ongoing conflicts in Gaza and other regional disputes around the globe.

While humanitarian concerns rightfully take precedence, investors must also comprehend how such geopolitical events influence market dynamics. The primary worry among market participants centers on whether these incidents might spiral into comprehensive global warfare. Although such escalation remains within the realm of possibility, recent historical precedent suggests otherwise. Major conflicts, including Russia’s Ukrainian invasion and Hamas’s Israeli offensive, have generally remained geographically contained, resulting primarily in temporary stock market turbulence.

This observation doesn’t minimize the gravity of these conflicts, but rather emphasizes that hasty portfolio adjustments in response to such events can prove detrimental. During these challenging periods, maintaining proper perspective and concentrating on historical lessons alongside long-term market patterns becomes crucial. What key areas should investors prioritize to maintain discipline during these uncertain market conditions?

Regional tensions in the Middle East have intensified

Recent events represent a significant escalation in Israel-Iran relations. Israeli military operations focused on Iranian nuclear installations and military command structures, with intelligence reports confirming damage to uranium processing facilities. Iran’s response included missile and drone counterattacks, with several projectiles successfully reaching Israeli territory. The confrontation has also compromised vital infrastructure across both nations, affecting natural gas installations and petroleum refineries.

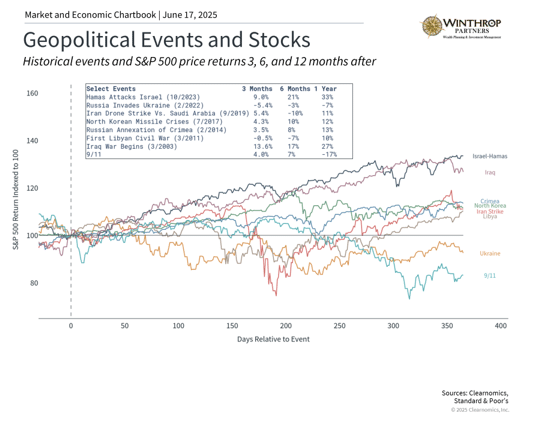

At the risk of oversimplification, historians generally approach each event as distinctive, possessing unique narratives, origins, and outcomes. Conversely, economists typically seek recurring patterns and commonalities between incidents to establish broader insights. For investors, both viewpoints prove valuable in determining which historical lessons remain applicable. After all, a familiar adage suggests that while history may not repeat precisely, it frequently echoes familiar themes.

The included chart offers historical context regarding geopolitical incidents spanning the last quarter-century. This encompasses Middle Eastern conflicts that influenced petroleum prices, such as Iran’s 2019 drone operations against Saudi Arabian targets. These episodes demonstrate that although markets may experience short-term fluctuations, they have consistently rebounded from geopolitical disruptions, typically within weeks or months following the initial incident. More significant during these periods were fundamental business cycle dynamics.

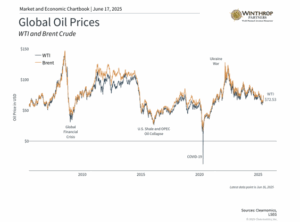

Petroleum markets have experienced significant volatility

In immediate terms, oil pricing serves as a key channel through which regional conflicts influence global markets. Initial market responses to recent conflicts centered on energy sectors, with Brent crude futures climbing beyond $74 per barrel. Oil pricing remains unstable but retreated toward $70 per barrel amid potential de-escalation possibilities.

Petroleum pricing significantly impacts the worldwide economy as oil remains a crucial component in manufacturing all goods and services. Elevated oil costs translate to higher gasoline and shipping expenses, increasing prices for consumers and enterprises alike. This effect intensifies with potential disruptions to vital shipping corridors, particularly the Strait of Hormuz in the Persian Gulf. This strategic waterway facilitates passage for roughly one-third of global oil shipments.

Nevertheless, maintaining perspective on current petroleum price levels remains essential. While recent fluctuations are noteworthy, prices stay considerably below 2022 peaks during early Russia-Ukraine conflict stages, when oil surpassed $120 per barrel. Present pricing around $70 falls within ranges experienced throughout recent years. Even within this year alone, oil prices have varied between $60 and $82 per barrel.

Additionally, the United States has achieved greater energy independence over the past two decades. American petroleum production currently surpasses 13.5 million barrels daily. Some may find it remarkable that America leads global production in both oil and natural gas. While the United States continues requiring foreign petroleum and remains sensitive to international oil pricing, substantial domestic supply helps shield the American economy and financial markets.

Warfare’s portfolio impact correlates with business cycle patterns

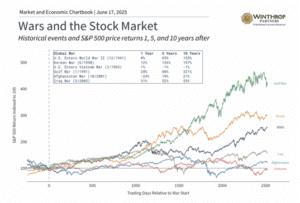

For investors concerned about escalating global conflicts, adopting a broader perspective proves helpful. From World War II through the Iraq War, markets may have responded to these conflicts initially, but long-term performance was ultimately determined by fundamental investment principles.

For instance, World War II stimulated industrial production following the Great Depression and created substantial labor market transformation as women joined the workforce. These elements helped drive economic growth throughout the remaining century. Similarly, while the Gulf War influenced oil pricing, it also coincided with the 1990s Information Technology boom. Conversely, the post-Vietnam War decade aligned with elevated oil costs and stagflation, producing disappointing market results.

Again, this analysis doesn’t diminish the human and social costs of these conflicts. Regarding current circumstances, outcomes will largely depend on whether tensions expand or begin subsiding. Major power involvement and threats to essential supply chains add layers of complexity, yet history indicates that even substantial regional conflicts typically exert limited long-term effects on international financial markets.

The bottom line? Although Middle Eastern tensions have generated temporary market instability, investors should preserve perspective and resist overreacting to news headlines. Maintaining a portfolio structured around long-term financial objectives remains the optimal strategy for navigating geopolitical uncertainty periods.

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Thomas Saunders is the Managing Partner of Winthrop Partners. Prior to founding Winthrop Partners, Tom was Senior Vice President at what is now JP Morgan. His career includes senior and executive roles at Brown Brothers Harriman and First Niagara Bank, a top 25 Bank. Click here to contact Thomas Saunders about your investment and planning requirements.