While inflation has dominated the headlines and consumed conversations over the past year, the topic is not a new one. From 1965 to 1982, Americans experienced what was referred to as the Great Inflation; inflation peaked at 14.8%, causing food and fuel prices to go up and a big loss in Americans’ purchasing power. How the government tried to manage inflation led to a significant recession and surging unemployment.

Though we’re not seeing the same extremes this time, we have learned enough to know that inflation can significantly impact our ability to grow wealth. To avoid repeating the same mistakes, Americans are adjusting how they manage their income, savings, and portfolios to help withstand a prolonged inflationary environment with the least amount of impact.

In this article, I discuss what inflation is, what causes it, and what you can do to minimize its impact on your retirement portfolio during times of high inflation.

What is inflation?

Inflation is the economic term for an increase in the price of fixed goods (or the decrease in the value of money) over time. Economists generally agree that inflation is neither inherently good nor bad. In fact, low inflation is not uncommon, and the government even accepts a 2-2.5% inflation rate as a normal occurrence. However, when that percentage creeps higher or prolonged inflation takes root, it can cause economic trouble such as bubbles or overheating in certain markets, and create hardship for people living in the economy’s periphery.

One key way to control inflation is to raise interest rates. In July of 2023, the Federal Reserve raised interest rates to 5.5%, a 22-year high and its 11th rate increase in the last 17 months – promising to “keep at it until the job is done”.

What Causes inflation?

The cause of inflation can’t be boiled down to one economic cause; however there are four main factors that can contribute to driving inflation in an economy.

1. Demand-pull inflation: When the growing demand for goods or services is met with insufficient supply, costs for those goods drive higher. An example of this was during the housing market boom. Low interest rates motivated people to take out loans to buy homes, increasing the demand, and leading to an increase in the prices in the housing market.

2. Cost-push inflation: When companies are already running at full production capacity and cannot find suitable alternatives, production and raw material prices are raised. Lumber costs fluctuating over the past five years are a prime example. After the pandemic, new construction, an increase in renovations, supply chain disruptions, and labor shortages resulted in excessive price surges, directly impacting the consumer.

3. Oversupply of money: The government has a dual mandate of stimulating growth and maintaining employment in the economy. Both the fiscal and monetary policies are used as tools by authorities to manage or stimulate the economy as needed.

-

- Fiscal Policy refers to how governments use taxation and spending to influence the country’s economy. This powerful tool can affect the demand of goods and services, the level of income, and the distribution of wealth and can be tweaked as needed. During volatile times such as a recession, the government may lower or increase spending to encourage demand and spur economic activity.

- Monetary Policy refers to the way a central bank of the government controls the money supply and interest rates in the economy. When the target core inflation rate rises much above the 2-2.5% target the Fed steps in opting to lower the federal discount rate and make it cheaper to borrow money. Their objective is to increase demand and raise prices to jumpstart the economy to better manage inflation. Though fiscal and monetary policy can positively influence the economy, it can also result in higher inflation and debt problems.

4. Inflation expectations: This is the rate at which consumers, businesses, and investors expect the price of goods to increase in the future. The effects of these predictions can directly impact the actual rate of inflation. For example, when inflation expectations get too high, they can lead to higher prices for goods and services, which can break down standards of living if wages don’t keep up with the average cost of living.

CaN INFLATION AFFECT YOUR INVESTMENTS?

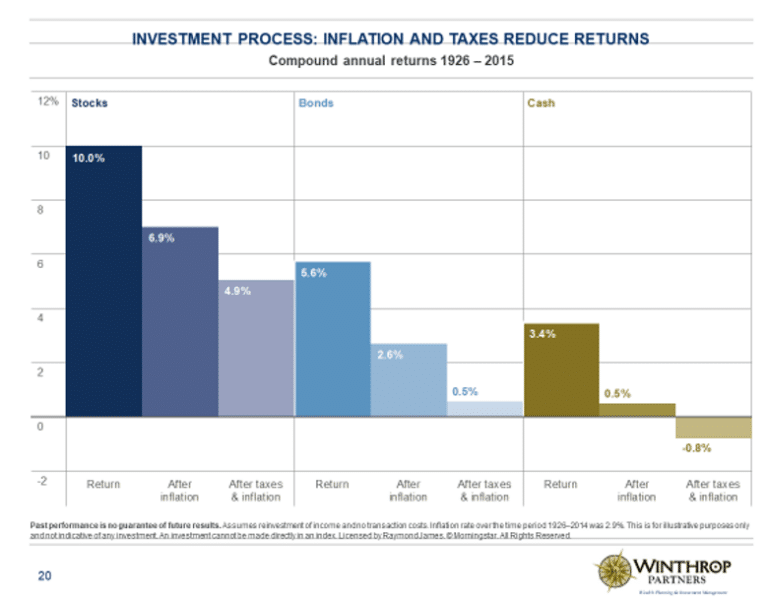

Inflation always influences your investments and over time can really decrease the value of your savings. As inflation increases, so does its impact and its return on cash, bonds, and equity. I often tell my clients, to take whatever your return is, subtract inflation, and that will give you your rate of return in that specific sector. To combat the inflationary risk, it’s important to anticipate and build a portfolio that can outperform during periods of high or rising inflation.

The best way to hedge against inflation in your portfolio

Though you’ll always be affected by inflation, there are ways to hedge against it. After all, not all investments do poorly in a high-inflationary environment and knowing where to focus your investments could help you weather the volatile times in the market.

Invest in the stock market

The way most investors handle inflationary times is by investing in the stock market. The reason for this is that the stock market offers capital appreciation as well as dividends with the hope that these companies can earn more than inflation. Though it doesn’t always happen, there’s still a chance it can reduce risk and ease your mind during volatile times.

Unlike stocks, investors tend to avoid bonds during high inflationary times. Inflation makes interest rates go up, which in turn decreases the bond’s value and ultimately erodes the purchasing power of a bond’s future returns.

Though there are core, growth, and value stocks, investors tend to favor growth stocks the most, followed by core stocks during inflationary times.

1. Growth stocks- most interested

Growth stocks contrast value stocks and can be a great way to earn life-changing wealth in the stock market since they grow rapidly (hopefully faster than inflation). Though they may look expensive initially, the valuations could be cheap if the company continues to grow – driving the share prices up. The downside is that growth stocks can be risky since they typically do not offer dividends. This means that the only opportunity that an investor has to earn money from their investments is when they eventually sell their shares. An example of this is Tesla.

2. Core stocks

Core holdings are the central investments of a long-term portfolio. They are known for their reliable service, consistent returns, and stable growth. Though they may not grow as rapidly or as large as growth stocks, they’re easy to monitor and rebalance resulting in less volatility and drawdowns while limiting any negative effects of taxes and trading commissions on returns. For example, JP Morgan.

What to avoid during times of inflation

The most important thing you can do is to avoid remaining in cash or cash equivalents during times of high inflation. It loses money. For example, if you have a dollar today and inflation is at 10%, that buys 90 cents worth of goods going forward, leaving you behind the mark in your investment goals.

In conclusion

No one knows what the future holds and it’s impossible to predict an outcome. At this stage, I think we’re all beyond worrying about inflation and are instead focused on riding out the storm. That’s why in our portfolio management, we hedge inflation concerns at the onset by creating diversified portfolios designed to meet our clients’ goals and avoid taking unnecessary risk.

At Winthrop Partners we are proud to be a fee-only fiduciary financial advisory firm that specializes in helping individuals and families with their wealth management needs. We’re also certified financial planners (CFPs) and chartered financial analysts (CFAs) which means we have the highest level of education and experience in the financial planning industry.

Whether you need help with building an investment portfolio, or managing your retirement planning, Winthrop Partners can create a financial plan that works for you.

Disclosures:

The views, opinions, and content presented are for informational purposes only. They are not intended to reflect a current or past recommendation; investment, legal, tax, or accounting advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. Nothing presented should be considered to be an offer to provide any product or service in any jurisdiction that would be unlawful under the securities laws of that jurisdiction. All investments involve risk, including the possible loss of some or all of the principal amount invested. Past performance of a security or financial product does not guarantee future results. Investors should consider their investment objectives, risks, and risk tolerances carefully before investing. The Firm has made every attempt to ensure the accuracy and reliability of the information provided, but it cannot be guaranteed.

Thomas Saunders is the Managing Partner of Winthrop Partners. Prior to founding Winthrop Partners, Tom was Senior Vice President at what is now JP Morgan. His career includes senior and executive roles at Brown Brothers Harriman and First Niagara Bank, a top 25 Bank. Click here to contact Thomas Saunders about your investment and planning requirements.