Many people know that stocks are an important part of long-term investment plans. When used as part of a complete financial strategy, stocks have historically helped people build wealth and reach their money goals. But this leads to a common question: which types of stocks should you own? While investors and news sources often talk about the biggest companies, there are many other types of stocks that can be useful in a well-rounded investment portfolio.

When people think about the stock market, they often think of the S&P 500 or the Dow Jones Industrial Average. The S&P 500 is a list (called an index) that follows 500 of the largest publicly traded companies in the U.S. These companies are ranked by market capitalization, which is a way to measure how big a company is based on its stock price and number of shares. The Dow is an index that includes only 30 large, well-known companies. Both focus mainly on companies that are based in the United States.

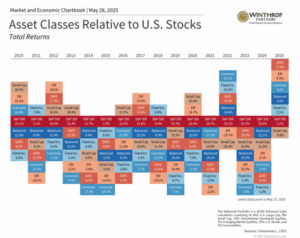

Because of how these indexes are built, they only include the largest U.S. companies. This can be useful for understanding the overall stock market and economy, since the biggest companies often drive major trends. However, when building investment portfolios, these indexes might miss other good opportunities. This is especially true when just a few “mega cap” stocks (the very largest companies), including those in the Magnificent 7, have been the main drivers of both gains and losses in the market.

In today’s market, how can investors look at more options? Small-cap stocks (shares of smaller companies) and international markets are two examples of areas that can provide opportunities and help spread out risk. Each has different qualities and possible benefits that can make a portfolio more diverse, especially during times when markets are unstable or the economy is uncertain.

Small company stocks have performed poorly but can help reduce risk

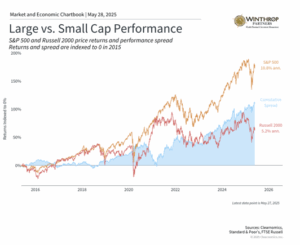

Small-cap stocks represent companies with market values that typically range from a few hundred million to a couple billion dollars. This is much smaller than mid and large-cap companies that range from tens to hundreds of billions, and mega caps which are now worth trillions of dollars.

The Russell 2000 index, which tracks how small companies perform, has earned 5.0% per year over the past ten years compared to 10.5% for the S&P 500, as shown in the chart.1 This performance gap has been especially large in recent years as the market has become more focused on large and mega cap companies, especially in technology and artificial intelligence sectors. Small companies typically have less involvement in the technology sector and earn more of their money from business within the U.S., making them more affected by changes in U.S. economic policies and trade conditions.

It’s worth noting that small company stocks have struggled so far this year due to ongoing uncertainty around tariffs and economic growth. However, this has made their prices potentially more attractive. Small-cap stocks are currently trading at more reasonable price-to-earnings ratios (a measure of how expensive stocks are) compared to large-cap stocks. The Russell 2000 currently has a price-to-earnings ratio well below its 10-year average. Even more striking is the price-to-book value of about 0.8x, much lower than the historical average of 1.2x. In comparison, many of the S&P 500’s valuation measures are well above average, if not near all-time highs.

Interest rates are another important difference between large and small companies. Small companies often rely more heavily on loans with variable interest rates than their large-cap counterparts, making them more sensitive to interest rate changes. While this created problems when interest rates rose quickly starting in 2022, the more stable environment since then could help. This is especially true if the Federal Reserve continues to cut rates later this year.

Many of these measures point to the fact that small-cap stocks are priced more attractively than many other parts of the market. While large company stocks will continue to play an important role in many portfolios, this shows that there are opportunities in many other parts of the market as well.

International markets continue to have attractive prices

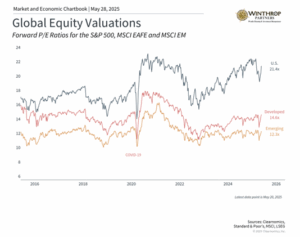

Another area with attractive prices is international stocks, which are typically divided into two main groups: developed markets (such as Europe, Japan, and Australia) and emerging markets (including countries like China, India, and Brazil). These categories reflect differences in how mature their economies are, how well their markets work, their rules and regulations, and more.

Although U.S. stocks have led global markets for much of the past ten years, international stocks have performed better this year. Specifically, the MSCI EAFE index, which tracks 21 key developed market countries, has gained about 17.5% year-to-date in U.S. dollar terms. The MSCI EM index, which tracks emerging markets, has risen 10%.2 This has happened despite global uncertainty due to trade issues.

Not only have these markets performed better this year, but the difference in prices remains large. While the S&P 500 trades at high price-to-earnings ratios, international markets offer more attractive valuations, as shown in the chart above. This is partly due to political and economic challenges in many of these regions over the past ten years, some of which have begun to improve.

One key difference between investing in the U.S. and internationally is that currency changes can affect returns. In particular, the weaker dollar has created good conditions for U.S.-based investors. This is because foreign investments increase in value when the currencies they are priced in get stronger, allowing them to be converted back to more dollars. This currency benefit has been a meaningful contributor to the strong performance of international stocks this year, providing an extra boost beyond the underlying performance of foreign companies.

It’s important to spread investments across regions and company sizes

For long-term investors, keeping some money in areas such as small-cap and international stocks can help create more balanced portfolios. This is especially true after the significant performance of large-cap stocks which have been driven by just a handful of the largest companies.

This doesn’t mean that U.S. large company stocks will become less important. This is also not an argument for making big changes to well-built portfolios. Instead, maintaining long-term portfolios is all about holding the right mix of all these types of investments. By including more attractively priced parts of the market, we can potentially improve long-run risk-adjusted results and take advantage of market opportunities. While any single type of investment may underperform during certain periods, their different characteristics and return patterns can provide valuable diversification benefits over time.

The bottom line? While the S&P 500 and Dow remain important measures, investors should consider the benefits of spreading their money across many other parts of the market, including smaller companies and international stocks. Holding appropriate portfolios for the long run is still the best way to achieve financial success.

- Russell 2000 and S&P 500, price returns, from January 2, 2015 to May 23, 2025

- MSCI EAFE and MSCI EM, total returns, January 1, 2025 to May 23, 2025

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Thomas Saunders is the Managing Partner of Winthrop Partners. Prior to founding Winthrop Partners, Tom was Senior Vice President at what is now JP Morgan. His career includes senior and executive roles at Brown Brothers Harriman and First Niagara Bank, a top 25 Bank. Click here to contact Thomas Saunders about your investment and planning requirements.