The second quarter of 2025 showed how strong financial markets can be, even when facing uncertain policies. The stock market dealt with many challenges, from new trade policies announced by the White House in April to rising tensions between Israel and Iran in June. Despite these worries, stocks bounced back quickly and reached new record highs by the end of the quarter.

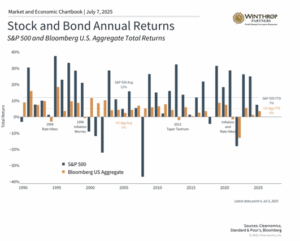

It was a good quarter for both stocks and bonds. For people investing for the long term, these events show that while news headlines can cause short-term ups and downs, keeping a long-term view and focusing on basic market trends is still the best way to reach your financial goals.

What Drove Markets in Q2

- The S&P 500 (a measure of large U.S. companies) and the Nasdaq (tech-heavy index) both hit record highs, gaining 10.6% and 17.7% respectively over three months. The Dow Jones rose 5.0% and is 2% below its record.

- The Bloomberg U.S. Aggregate Bond Index (a measure of bond performance) gained 1.2% in the quarter. The 10-year Treasury yield (interest rate on government bonds) ended at 4.2% after reaching 4.6% in May.

- International developed market stocks rose 10.6% and emerging market stocks increased 11.0% during the quarter.

- Gold reached a new record of $3,431 per ounce before ending the quarter at $3,308.

- Bitcoin hit a high of $111,092 in May and was around $107,000 at the end of June.

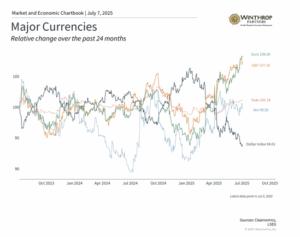

- The U.S. Dollar Index (which measures the dollar’s strength) continued falling, ending at 96.88 compared to 108.49 at the start of the year.

- The Consumer Price Index (which measures inflation) rose 2.4% year-over-year in May, while core inflation (excluding food and energy) was 2.8%.

- The University of Michigan Consumer Sentiment Index (which measures how confident consumers feel) improved to 60.7 in May. Consumers expect inflation of 5.0% over the next year, down from 6.6% in the previous survey.

- The Federal Reserve (the central bank) kept interest rates unchanged at 4.25% to 4.5% at its June meeting.

Stock markets bounced back to record levels

Even with big swings in prices, the stock market recovered fast once investors realized the worst fears about trade policies and global tensions wouldn’t happen. The quarter started with worry after new tariffs (fees on imported goods) were announced on April 2, which were broader than many investors expected. But as the government began talks and reached early trade deals with several partners, investor confidence improved. The Middle East conflict had a similar pattern – markets stayed strong overall and reached new highs after a ceasefire between Israel and Iran was announced.

The stock market recovery was broad, with many different sectors, investment styles, and regions doing well. International stocks continue to lead in 2025, especially as the dollar gets weaker. Small company stocks have done worse than other parts of the market because they’re more affected by tariffs and domestic trends – the Russell 2000 index (which tracks small companies) is still down 2.5% this year.

Looking at different sectors within the S&P 500, Information Technology stocks recovered strongly and helped push markets to new highs. Many other sectors are also supporting markets, including Industrials (up 11.4% this year), Communications (up 10.2%), and Financials (up 7.5%). Healthcare and Energy sectors saw weakness.

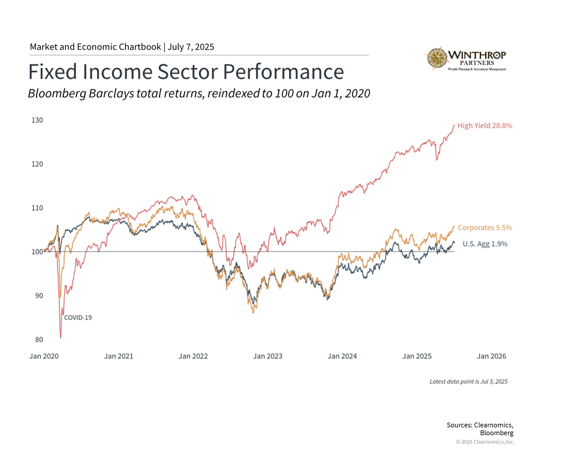

Bond markets are also quietly helping portfolio performance, with relatively high yields (interest payments) and falling credit spreads (the extra interest riskier borrowers pay) during the quarter. Treasury securities (government bonds) and corporate bonds also had ups and downs during the tariff-related market drop, but ended the quarter with gains.

The dollar kept getting weaker

The U.S. dollar weakened during the second quarter despite tariff pressures. While a weaker dollar can hurt consumers (making imports more expensive), it can help U.S. businesses and exporters because it becomes cheaper for people using foreign money to buy American goods. Though the dollar has fallen this year and is near the low end of its range since 2022, it’s still high compared to the past ten years.

For monetary policy (how the central bank manages money supply and interest rates), the Federal Reserve kept interest rates steady at 4.25% to 4.5% throughout the quarter. This reflects a careful approach to policy in a changing economic environment. Fed Chair Jerome Powell emphasized the Fed’s focus on keeping prices stable even as other factors make the economic outlook more complicated.

The Fed’s updated economic forecasts show the challenges policymakers face. Officials now expect inflation to reach 3% in 2025 before dropping to 2.1% by 2027, which is higher than earlier predictions. They also expect real GDP growth (economic growth after adjusting for inflation) to slow this year to 1.4%, down from a 1.7% forecast in March. These changes reflect worries that tariffs could increase inflation and slow growth.

The conflict between Israel and Iran added another challenge to an already difficult environment. Israeli strikes on Iranian nuclear facilities and military targets starting June 13 created immediate concerns about regional stability and potential escalation. However, the two countries agreed to a ceasefire after 12 days of fighting.

Bonds helped provide portfolio stability

While the stock market ended the quarter at new record highs, the decline and recovery was challenging for many investors. Fortunately, bonds helped support balanced portfolios (which include both stocks and bonds) during the quarter. High yield bonds (riskier corporate bonds), corporate bonds, and Treasury bonds all provided balance and are positive year-to-date. Interest rates have stayed higher than many expected, and short-lived concerns in April about people selling U.S. Treasury securities didn’t happen.

Budget discussions in Washington have brought renewed attention to America’s government spending. The national debt now exceeds $36 trillion, or about $106,000 per American. According to the Congressional Budget Office, the latest budget proposal could add an estimated $3.3 trillion in deficits (when spending exceeds income) over the next decade. While the proposal includes spending cuts, these are outweighed by tax cuts and spending increases elsewhere.

Moody’s (a credit rating agency) downgraded the U.S. credit rating in May, citing concerns about successive administrations and Congress failing to address “large annual fiscal deficits and growing interest costs.” This echoes similar challenges raised during previous budget standoffs in 2011, 2013, and from 2018 to 2019. However, in each case, agreements were eventually reached, markets stabilized, and economic growth resumed.

For long-term investors, these budget debates highlight the importance of maintaining diversified portfolios (spreading investments across different types of assets) that can handle various policy outcomes. While deficit levels deserve attention, history suggests that the U.S. economy’s fundamental strengths and ability to adapt remain strong.

The bottom line? The second quarter showed both market volatility and strength as investors dealt with policy changes and global tensions. For investors, keeping perspective and focusing on asset allocation strategies (how you divide your money among different investments) remain the most effective way to achieve long-term goals.

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Thomas Saunders is the Managing Partner of Winthrop Partners. Prior to founding Winthrop Partners, Tom was Senior Vice President at what is now JP Morgan. His career includes senior and executive roles at Brown Brothers Harriman and First Niagara Bank, a top 25 Bank. Click here to contact Thomas Saunders about your investment and planning requirements.