The Inflation Challenge Retirees Can’t Ignore

Inflation doesn’t just make groceries or gas more expensive, it quietly eats away at your purchasing power over time. For retirees, that can mean the difference between a comfortable lifestyle and one that feels increasingly stretched.

Even though inflation has cooled from the highs of 2022 and 2023, prices haven’t fallen. Healthcare, housing, and food continue to climb faster than the overall average. For retirees living on fixed income sources, that steady erosion can be hard to ignore.

That’s why building a resilient retirement portfolio, one that adjusts as prices change, is so important heading into 2025.

Winthrop Partners advisors serve clients in Pittsburgh, Buffalo, and Doylestown (Philadelphia area), helping retirees plan portfolios that adapt to changing inflation and protect long-term purchasing power.

How Inflation Impacts Retirees

Inflation works like a slow-moving tax. A dollar today simply won’t buy as much tomorrow. Retirees who rely on fixed income sources, like pensions, annuities, or Social Security, feel the squeeze most.

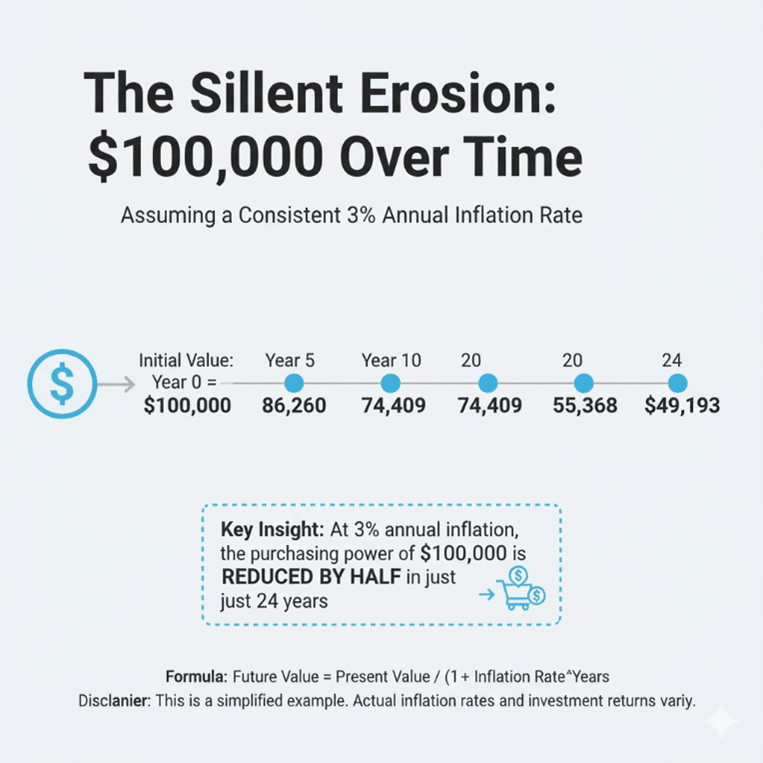

Even modest inflation can make a big difference. At just 3% per year, the cost of living doubles roughly every 24 years. What costs $100,000 today could cost $150,000 in the not-too-distant future. Without an inflation-conscious strategy, retirees risk watching their savings lose ground faster than expected.

Social Security’s Cost-of-Living Adjustment: Helpful, but Limited

The Social Security Administration (SSA) announced a 2.8% cost-of-living adjustment (COLA) for 2026. While any increase helps, it’s far below the 8.7% jump retirees received in 2023, the largest in four decades. That 2.8% translates to roughly a $56 monthly increase for the average retiree, bringing total benefits to about $2,064 per month. But higher prices for essentials like food, housing, and healthcare can quickly outpace that bump.

The issue is that even when inflation cools, prices don’t fall, they simply rise more slowly. And because the COLA calculation is based on the CPI-W, which reflects spending by working households, it often understates the true costs retirees face. Major expenses such as health care, housing, and insurance tend to rise faster than overall inflation.

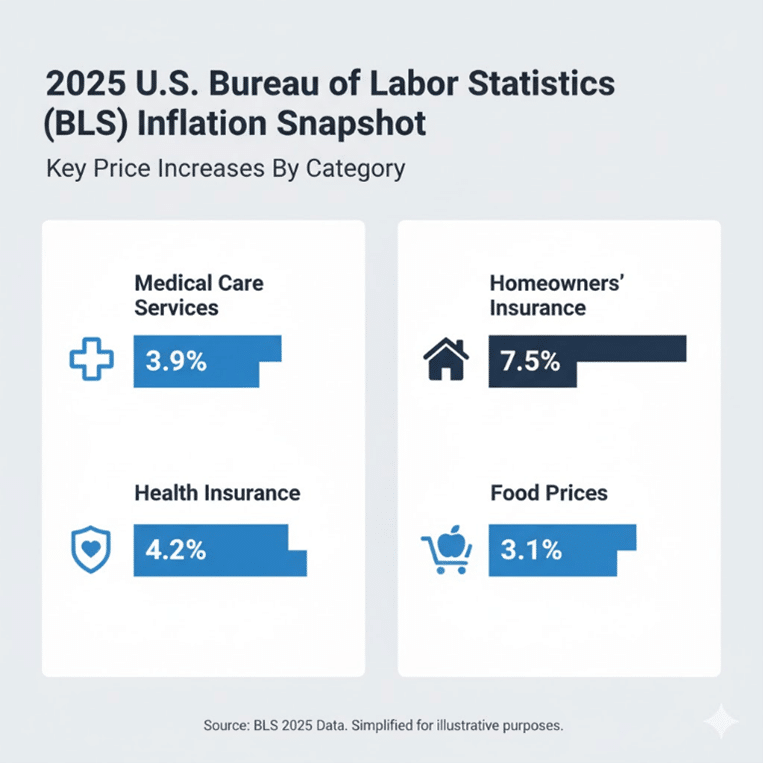

According to recent data from the U.S. Bureau of Labor Statistics (BLS) , here’s how this has played out in 2025:

· Medical care services rose 3.9%

· Health insurance jumped 4.2%

· Homeowners’ insurance premiums increased 7.5%

· Food prices were up 3.1%, with meats and fish climbing over 6%

Medicare Premiums Offset Gains

Adding to the challenge, Medicare Part B premiums are projected to rise from $185 to $206.50 per month in 2026. That $21.50 increase could consume roughly 40% of the average retiree’s COLA, leaving little real improvement in purchasing power.

Longevity Risk: Planning for a Longer Retirement

Today’s retirees are living longer than ever. The average 65-year-old man can expect to reach age 83; for women, it’s 86, and many will live well into their 90s. Longer lifespans are a blessing, but they also mean more years of spending.

That is longevity risk: the chance of outliving your assets. Planning for a 30-year retirement, not just 20, requires a careful balance between safety and growth. A well-structured, diversified portfolio and a thoughtful retirement planning strategy can help savings last even as life expectancy and costs rise.

Why Cash Isn’t the Safe Haven It Once Was

When interest rates climbed in recent years, cash accounts and money market funds offered decent returns. But as the Federal Reserve begins easing rates again, those yields are likely to slip below 3% by mid-2026.

Holding too much cash may feel safe, but it carries a hidden cost: inflation erosion. Every dollar sitting idle loses value as prices rise. A better approach is to keep 12-24 months of expenses in cash or short-term reserves, while investing the rest in assets designed to grow or adjust with inflation.

Five Time-Tested Strategies to Build a Resilient Retirement Portfolio

- Maintain a Balanced Mix of Assets

A diversified portfolio can help balance short-term stability with long-term growth. For many retirees, that might look like:

· 40–60% in equities for growth

· 30–40% in fixed income for income and stability

· 10–20% in alternatives such as real assets or inflation-linked securities

- Use Inflation-Resistant Investments

Consider Treasury Inflation-Protected Securities (TIPS), Real Estate Investment Trusts (REITs), and select commodities to help offset rising costs. - Focus on Dividend-Growth Stocks

Companies with a track record of raising dividends, like utilities or consumer staples, can provide income that tends to keep pace with inflation. - Manage Withdrawals Carefully

Flexible spending and withdrawal strategies (such as an inflation-adjusted 4% rule) can help your portfolio last through different market cycles. - Work With a Fiduciary Advisor

A Certified Financial Planner can design a plan that aligns with your goals, risk tolerance, and evolving market conditions.

Professional Guidance: Your Best Defense Against Inflation

Inflation affects every retiree differently. A trusted fiduciary advisor can help you:

· Model inflation’s impact on your income streams

· Reassess your investment management process as rates and markets shift

· Optimize Social Security and Medicare decisions

· Identify tax-efficient strategies to preserve after-tax income

If you’d like to explore how inflation could affect your plan, schedule a consultation with one of our advisors in Pittsburgh, Buffalo, or Doylestown (Philadelphia area).

You can also visit Our Blog for more visit more insights on retirement and investing.

FAQs About Inflation and Retirement

How much inflation should I plan for in retirement?

Many plans assume 2 to 3% annual inflation; consider 3 to 4% for healthcare costs.

Is now a good time to invest in stocks for retirement income?

In 2025, equities remain one of the best ways to outpace inflation over the long run.

How can I stretch my Social Security income further?

If possible, delay claiming benefits and combine them with inflation-adjusted investment income.

Should I still keep some cash reserves?

Yes, to cover 12-24 months of living expenses during market volatility.

Are bonds still useful in an inflationary period?

Yes, particularly short-duration and inflation-linked bonds, which help balance risk and provide steady income.

How often should I review my retirement plan?

At least annually, or anytime there’s a major change in the economy or your personal situation.

Conclusion: Building Inflation Resilience for the Long Run

Inflation isn’t going away, it’s just changing shape. The goal isn’t to avoid it, but to adapt your portfolio so it continues to serve you through different economic conditions.

By staying diversified, maintaining a long-term view, and partnering with a fiduciary advisor, you can keep your financial plan on course, whatever inflation does next.

Winthrop Partners advisors serve clients in Pittsburgh, Buffalo, and Doylestown (Philadelphia area), helping retirees plan portfolios that adapt to changing inflation and protect long-term purchasing power.

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Brian Werner is a Managing Partner at Winthrop Partners. He has more than 25 years of experience in investments, financial planning, entrepreneurial ventures, corporate finance, and banking. Prior to joining Winthrop Partners, Brian was the First Vice President and a Senior Wealth Advisor for First Niagara, where he led the development of First Niagara’s Western Pennsylvania Private Client Services and served on its western Pennsylvania operating committee. He also held roles with PNC/National City, Greycourt Investment Advisors, and Linnco Future Group, Chicago Board of Trade. Brian is a Chartered Financial Analyst and Certified Financial Planner. He earned his MBA from Duquesne University, Magna Cum Laude.