Just as natural disasters come in different forms – sudden earthquakes versus gradual erosion – economic challenges also vary in their timing and intensity. While some financial risks appear overnight, others develop slowly over years or decades. Inflation represents one of the most persistent threats to long-term wealth, combining both immediate price shocks and the steady decline of purchasing power that can devastate unprepared portfolios.

Today’s investors face a familiar challenge that echoes the experiences of the 1970s and early 1980s, as well as the recent post-pandemic period. Current inflation remains more persistent than many anticipated, with ongoing discussions about how tariffs might influence consumer prices. Yet this inflationary pressure coincides with robust employment levels, strong consumer spending patterns, and solid corporate earnings. This dynamic creates a challenging landscape for both market participants and monetary authorities as they navigate the delicate balance between economic expansion and price stability.

Smart investors recognize the importance of proactive planning rather than reactive responses to inflation concerns. Building resilient portfolios that can perform across various economic scenarios while maintaining focus on long-term objectives remains crucial. How should current inflation trends inform our understanding of economic conditions and investment strategy?

The steady erosion of purchasing power through inflation

While zero inflation or even deflation might appear beneficial from a consumer perspective, these conditions can signal economic distress rather than prosperity. Contemporary economic frameworks recognize that modest positive inflation, typically around 2% annually, creates optimal conditions for both individual prosperity and broader economic health.

This moderate price growth provides monetary authorities with policy flexibility, encouraging appropriate spending and investment behaviors while preventing deflationary cycles where declining prices discourage current consumption in favor of waiting for lower future costs.

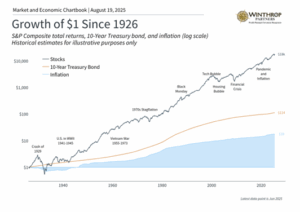

The distinction between individual and economy-wide impacts remains critical. While 2-3% annual inflation historically supports healthy economic expansion, even these seemingly modest rates can significantly impact savers and investors over time. Though these levels pale compared to the extreme inflation of previous decades or recent pandemic-era spikes, their cumulative effects prove substantial.

Consider that 3% annual inflation doubles costs approximately every 24 years. This means today’s $100,000 purchasing power would require $200,000 in two decades – a timeframe covering typical retirement periods. This erosion particularly challenges retirees and cash holders, while establishing a minimum return threshold that all investments must exceed to generate real wealth growth.

Current inflation remains persistently elevated

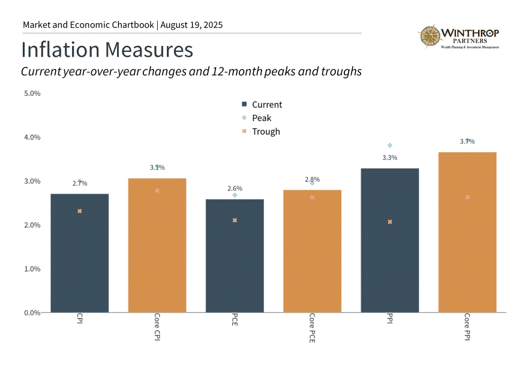

Current inflationary pressures reflect both immediate concerns about tariff impacts and underlying economic trends. Recent Producer Price Index data reveals significant wholesale price increases, with July showing a 0.9% monthly surge – the largest since June 2022 and well above economist projections. Goods prices climbed 0.7% while services jumped 1.1% in a single month.

1

These wholesale price movements typically translate to consumer price increases after several months as costs work through supply chains. This pattern suggests businesses may be beginning to pass tariff-related expenses to customers after initially absorbing these costs.

Consumer Price Index data shows more moderate but still concerning trends, with annual headline inflation reaching 2.7% and core inflation (excluding volatile food and energy) at 3.1%. Housing costs drove much of this increase, reflecting persistent shelter price pressures.

2

These statistics translate directly into household budget pressures in areas consumers notice most acutely. Restaurant prices increased 3.9% annually, medical care costs rose 3.5%, and auto insurance premiums jumped 5.3%. Even furniture prices climbed 3.4%, adding strain to family finances already pressured by years of elevated costs.

Strategic asset allocation remains key to inflation protection

While current increases remain notable, inflation sits well below the double-digit rates experienced during 2021-2022. However, even without sudden tariff-driven price spikes, sustained higher average price levels may continue eroding cash values, particularly when wage growth fails to match price increases and portfolios lack inflation-beating allocations.

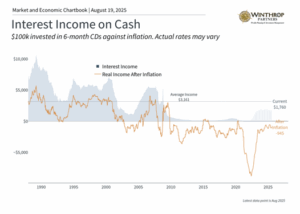

Understanding inflation’s portfolio implications becomes essential for long-term success. Historical data shows cash returns frequently lagging inflation rates, yet money market fund assets remain at record $7.1 trillion levels despite declining short-term rates.

3

Historical evidence suggests both equity and bond investments have exceeded inflation over extended periods, as earlier charts demonstrate. However, stocks can experience significant volatility during inflationary environments, as 2022 clearly showed. Diversified asset allocation strategies that can weather both inflation and market turbulence help investors maintain progress toward their goals.

Most critically, investors should avoid dramatic portfolio adjustments based on monthly inflation data or tariff speculation. While ensuring portfolios can handle various scenarios remains important, overreacting to short-term information frequently results in poor timing decisions that undermine long-term financial objectives.

The bottom line? Inflation’s persistent erosion of purchasing power represents a fundamental investment challenge that requires portfolios capable of generating both income and growth to achieve long-term financial success.

Ryan Carney is a Partner at Winthrop Partners. With nearly 10 years of experience in financial services, Ryan began his career with Fidelity Investments and First Niagara Financial Group. In 2018 he was named by Buffalo Business First’s as a “30 under 30” honoree. He earned his B.S. in Economics from Bowdoin College and is a Certified Financial Planner.