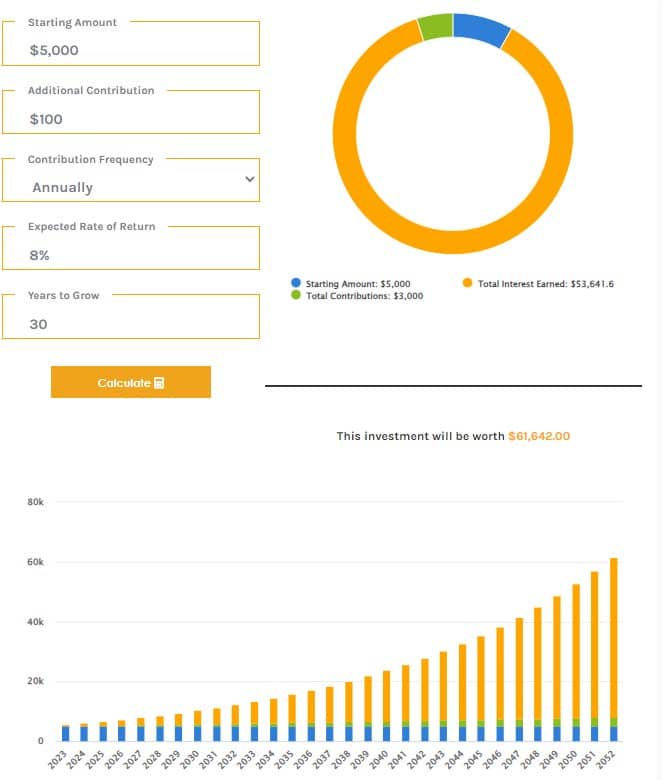

Winthrop Partners’ Smart Investing Calculator will help you see how much and how frequently you need to invest your money to reach your financial goals.

Our investment calculator can offer a glimpse into how your initial investment, frequency of contributions, and expected rate of return can affect how your money grows.

With this simplified visual, you can make more informed decisions about your investment and potentially maximize growth. It can also help you determine how much you need to save each month to reach your financial goals.

This investment will be worth -

Year Starting Amount Annual Contribution Total Contribution Interest Earned Total Interest Earned End Balance

DEFINITIONS

STARTING AMOUNT: Total amount that you’ll initially invest or have currently invested toward your investment goal.

ADDITIONAL CONTRIBUTION: The amount that you will contribute to your investment. Any contribution made during the life of the investment will result in a more accrued return and a higher end value.

CONTRIBUTION FREQUENCY: The frequency that you will make regular contributions to this investment.

EXPECTED RATE OF RETURN: This is the rate of return you expect from your investments. The actual rate of return is largely dependent on a variety of factors, including, but not limited to the types of investments you select and material economic and market factors, such as levels of inflation and level and rate of change of short and long-term interest rates.

YEARS TO GROW: The number of years you have to save.

ANNUAL CONTRIBUTION: The amount that you will have contributed annually towards your investment.

TOTAL CONTRIBUTION: Total amount that you will have invested toward your investment goal by a particular date.

INTEREST EARNED: The amount of interest earned from your investments in the form of regularly mandated payments in a period of time.

TOTAL INTEREST EARNED: The total amount of interest earned towards your investment to date.

END BALANCE: The desired balance at the end of the life of the investment.

At Winthrop Partners, we take pride in getting to know our clients, understanding their needs, and guiding their financial goals based on their unique risk profile. To learn more about financial planning, investment management, and how to secure a fiscally sound future for your long term goals, schedule a free consultation today.

Disclosures:

The views, opinions, and content presented are for informational purposes only. They are not intended to reflect a current or past recommendation; investment, legal, tax, or accounting advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. Nothing presented should be considered to be an offer to provide any product or service in any jurisdiction that would be unlawful under the securities laws of that jurisdiction. All investments involve risk, including the possible loss of some or all of the principal amount invested. Past performance of a security or financial product does not guarantee future results. Investors should consider their investment objectives, risks, and risk tolerances carefully before investing. The Firm has made every attempt to ensure the accuracy and reliability of the information provided, but it cannot be guaranteed.

The Smart Investing Calculator is for illustrative purposes only and is not intended to be indicative of future results. The projections or other information generated by the Smart Investing Calculator are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. The projections do not reflect fees or expenses of utilizing an investment advisory firm, such as Winthrop Partners, to manage your money. The hypothetical results may vary significantly depending on the information that is put into the Smart Investing Calculator. Actual performance and returns may be higher or lower than those depicted by the Smart Investing Calculator. The information provided herein does not undertake to explain the risks associated with any investment. Before taking any investment action, you should first consult with a qualified professional.