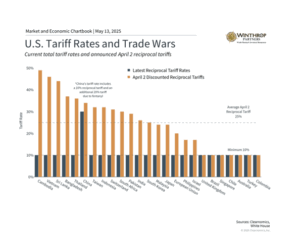

The U.S. and China recently announced a trade agreement that reduces many of the tariffs that caused market concerns since April. This 90-day deal lowers U.S. tariff rates on Chinese products from 145% to 30%, while China’s rates on U.S. goods drop to 10%. Along with paused tariffs on other trading partners and a new trade deal with the U.K., investors are feeling more optimistic that a long trade fight might be avoided. How does this change affect your long-term investments?

Markets dislike uncertainty and unexpected bad news more than anything else. This is because when something concerning happens, markets often react to the worst possible outcome right away, then adjust as more facts become available. While the surprisingly large April 2 tariffs caused markets to drop sharply, they’ve bounced back quickly over recent weeks.

Markets are now close to their beginning-of-year levels and slightly higher than before the April 2 tariff announcement. This pattern matches many other times in history when markets recovered once the situation became clearer. These recent events remind us why keeping a long-term investment perspective is so important during uncertain times.

The U.S.-China agreement shows a broader deal might be possible

The new tariff agreement between the U.S. and China is good news because it removes a major source of market uncertainty. It sets the U.S. tariff on Chinese goods at 10% while keeping the 20% tariff related to the fentanyl crisis that was put in place earlier this year. While things are still developing, this agreement opens the door for a longer-term trade deal between the world’s two biggest economies and reduces tensions. So, even though tariff rates are higher than before, the worst possible outcome now seems less likely.

Looking back, recent events look similar to the trade tensions during President Trump’s first term in 2018 and 2019. In both cases, the administration has used tariffs as a negotiating tool to try to get new trade deals, with the goal of reducing the U.S. trade deficit with major trading partners. Five years ago, this led to the “Phase One” trade agreement with China, the USMCA (United States-Mexico-Canada Agreement), and other deals.

These trade policies have many connected goals, including supporting manufacturing jobs, protecting intellectual property, controlling immigration, and more. The main difference today is that the administration has gone much further with tariff threats than many investors and economists expected. Still, the recent trade deal between the U.S. and the U.K. suggests similar patterns may be happening again. That agreement sets a basic 10% tariff rate on U.K. goods, with special provisions allowing up to 100,000 imported cars at this level and exceptions for steel and aluminum.

The economy has remained strong despite trade uncertainty

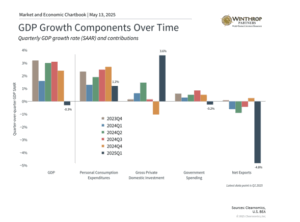

Of course, final trade deals with China and many other countries aren’t complete yet, and daily news could continue to cause market swings, especially if previous tariff pauses end. Markets have focused so heavily on tariffs because they affect inflation and economic growth. This showed up in the first quarter’s GDP figure, which revealed a slight economic shrinking as businesses stocked up on imported goods before tariff deadlines. Having more clarity will likely help both consumers and businesses.

In this situation, what other positive developments could happen? First, many economic indicators remain healthy. The latest jobs report showed the economy added 177,000 positions in April, better than the expected 138,000. The unemployment rate stayed at 4.2%, continuing a period of stability that began last May. The strong job market helps reduce worries that tariffs and uncertainty will hurt consumer spending.

At the same time, inflation continues to gradually slow toward the Fed’s 2% target, with the latest Consumer Price Index showing 2.4% year-over-year. This slowing has been helped by falling oil prices, which recently hit four-year lows. Cheaper oil, partly caused by tariff-related market swings, helps lower costs for consumers and can boost the economy, all else being equal.

The recent U.S.-China agreement also reduces pressure for immediate Fed interest rate changes. Markets still expect the Fed to cut rates this year, but now they’re only expecting two or three cuts, possibly starting in July or September. The Fed, which recently kept rates steady between 4.25% and 4.5%, seems to be watching and waiting rather than reacting quickly to short-term trade, market, and economic news.

Markets often recover when you least expect it

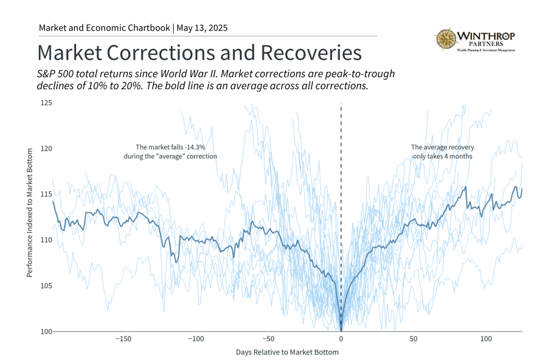

While many risks still exist, the last several weeks show how quickly the market story can change. By their nature, markets tend to prepare for worst-case scenarios. During times of negative news and market drops, it’s hard to imagine the market will ever recover. So, while understanding risks is always wise, it shouldn’t come at the expense of your long-term investment plan.

The chart shows how market corrections (drops) have behaved since World War II. While the average correction sees a decline of 14%, it often recovers in as little as four months. Most importantly, markets can often bounce back when least expected, as we’ve seen following recent progress on trade talks. Investors who overreact to early signs of trouble may find themselves poorly positioned for their financial goals.

The bottom line? The latest U.S.-China trade announcement has reduced market uncertainty and fears of a recession. For long-term investors, this reinforces the value of staying calm during market turbulence rather than making sudden changes based on short-term market swings.

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Thomas Bunting is a Financial Advisor at Winthrop Partners. He has more than 50 years of experience in accounting, financial planning, and tax planning. Prior to joining Winthrop Partners, Tom held the roles of partner, managing partner, and senior partner with a mid-sized CPA firm that provided a full range of accounting, tax and financial planning services.

Tom is a member of the American Institute of Certified Public Accountants, the Personal Financial Planning and tax sections of the American Institute of Certified Accountants, and the Pennsylvania Institute of Certified Public Accountants. He was also a former member of the AICPA governing council and a past president of the PICPA. He earned his BS in Accounting from Temple University.