Financial advisors are frequently asked for the single best piece of financial advice they could give an investor. We believe the single best piece of advice is to stay the course with an established, risk-appropriate, properly allocated, and well-diversified portfolio. While our previous blogs and white papers address elements of creating sensible financial strategies, this blog post focuses on investment consistency. Although investment strategies can vary widely based upon the investors’ ability to absorb risk, their investment timeline, and their investment goals, the common ingredient for success with all these strategies is the discipline to stay the course.

Staying the course does not mean you never change your investment strategy. For instance, your investment strategy should evolve as you age, as your goals change or as tax laws, government policies, or as departmental or agency rules change, but your strategy should not change due to the projected impact of elections, market volatility, investment fads, or so-called “expert’s pronouncements” that the market has entered a new investment paradigm.

Avoiding The Market’s Siren Song and Other Temptations for Investors like “The Brass Ring,” “The End is Near,” or “Market Timing” impulses:

The market is always tempting you to deviate from your established strategy. For instance, tempting you to purchase a faddish stock when the market is rising (Brass Ring) or selling your portfolio when the market drops (The End is Near). The market is not the only culprit; the news media or other “experts” create their own siren songs claiming that the current election, investment trend, or market move is historic and marks the beginning of a new paradigm where established rules no longer apply. Faced with these distractions and their harmful effects, successful investors have learned the simple lesson to not deviate from their strategy by acting on impulses and emotion. Making a change to your investment portfolio requires making two correct decisions: what to sell and what to buy. Emotion-driven decisions seldom consider the flip side of the trade or the big four categories of risk: market, operational, credit, and liquidity risk, which impacts the value of all securities.

Investors sometimes state, “staying the course is a great strategy for someone who can afford to ride out the market cycles, but I have to take risks like trying to time the market to achieve my goals because I can’t afford large losses in a downturn” (Market Timer). This type of thought is a self-imposed problem. This investor frequently carries a portfolio that is too risky for them, and they either sell out in anticipation of a decline that doesn’t materialize or sell out at close to the bottom of a market decline. Usually, the Market Timer’s risk profile does not align with their portfolio allocation, but occasionally the issue lies with their investment short time horizon, their lofty goals, or their low investment contribution rate.

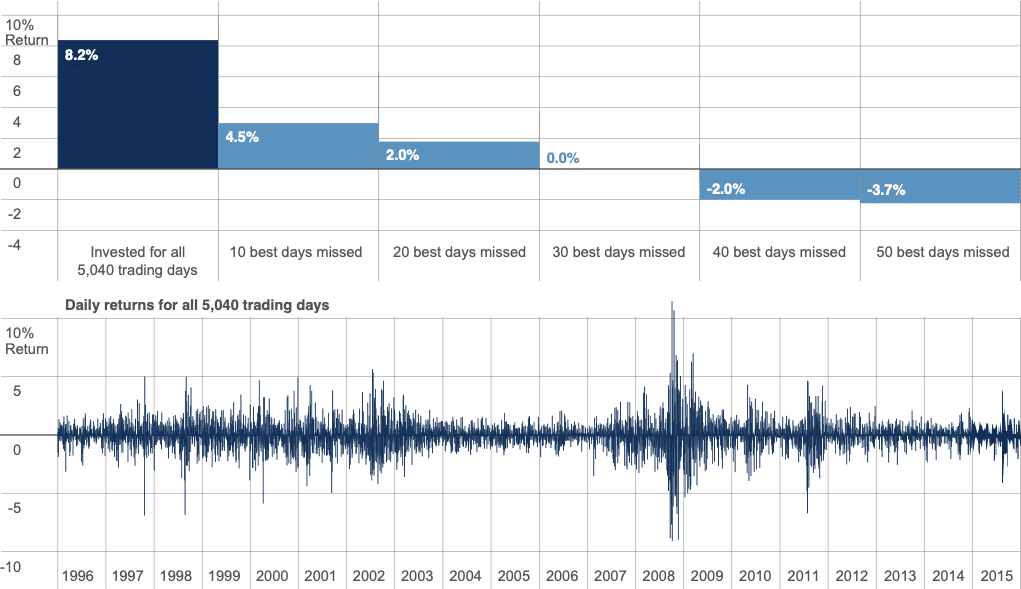

What is the Magic of Staying the course? The following charts illuminate the benefit of consistent investment, and three overriding factors become apparent:

- Markets can move quickly with no advanced notification.

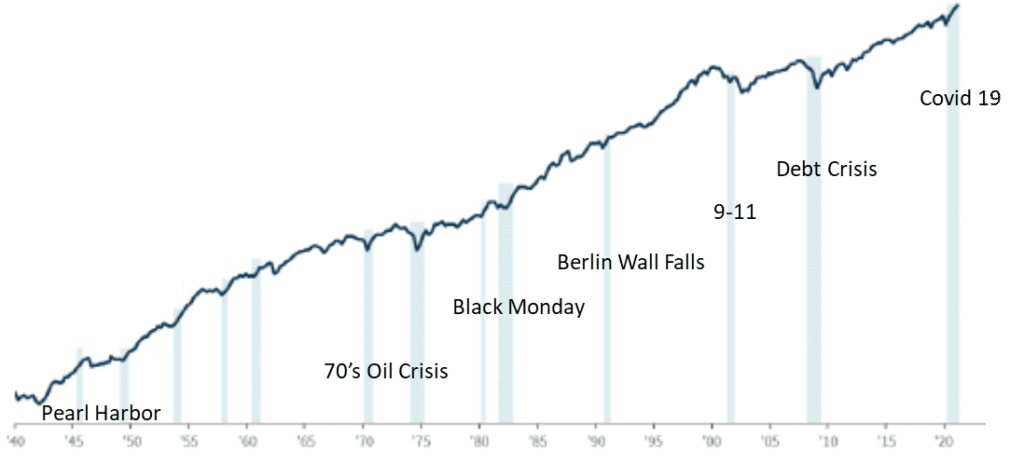

- With very few exceptions, most notably the 1940s Depression and 2008 credit crisis, market declines are quickly followed by market increases that more than restore portfolio values.

- Large positive market moves tend to come in just a few quick market bursts, and missing one can be very detrimental to overall returns.

Investors Risk of missing the best days in the market 1996-2015:

But the real magic of staying the course lies in the fact that the market has historically increased over the long-term no matter what crisis it has confronted. Comedian Chris Rock once joked about the lottery saying, “You have to be in it to win it.” The kernel of truth in the joke also applies to investor participation in the market. If you are anticipating or reacting to market moves you could be out of the market at the wrong time or making incorrect guesses about the timing of purchases and sales. Remember, no one can predict the future. It’s best to be consistently in the market with an investment strategy that meets your needs throughout the market’s cycle.

Despite the many crises the market has encountered over the years, the market continues to climb. Therefore, when possible, investors should focus on the long term and remain in the equity market while resisting temptations. Furthermore, investors should incorporate bonds or other stable value holdings in their portfolios to convert to cash during periodic downturns rather than liquidating equities during a downturn.

As a Chartered Financial Consultant at Winthrop Partners, Jennifer works closely with clients

and advisors in all areas of the financial planning process. On a daily basis, her key role is the

operations of the firm. With over 29 years of experience, she prides herself with providing

clients with a consistent high-quality experience when doing business with Winthrop Partners.