Global markets have been rattled by escalating trade tensions and recession fears. As China implements reciprocal trade measures in response to new tariffs, investors worldwide are growing increasingly concerned about a potential trade conflict. This uncertainty has triggered market declines across Asia, Europe and the United States, while driving a surge in bond prices as investors seek safer assets.

Strategic portfolio management is critical in today’s environment

Just as championship teams need both strong offense and defense, successful investing requires a dual approach. Defensive positioning helps protect portfolios during various market conditions. Given that market volatility and unexpected events are inevitable, maintaining defensive elements is essential for long-term success.

Offensive strategies allow investors to capitalize on opportunities that arise during market dislocations. While periods of uncertainty can be uncomfortable, they often present attractive entry points for long-term investors. A well-constructed portfolio needs both elements to achieve optimal results. The key question is how to structure portfolios to both protect capital and capture upside in the current environment.

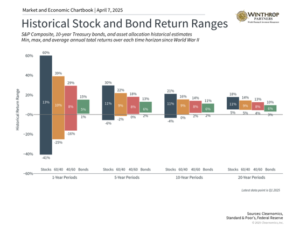

Diversification and maintaining a long-term perspective are foundational investing principles. The accompanying chart illustrates these concepts by showing historical return ranges across different asset types and time periods. The data reveals significant short-term variability in stock returns, ranging from +60% in 1983’s recovery to -41% during the 2008 financial crisis.

Examining longer time horizons and diversified portfolios demonstrates the power of these investment approaches. While diversification may limit maximum potential returns, it also reduces downside risk, as shown by the balanced 60/40 stock-bond portfolio. This year’s market action illustrates this effect – while the S&P 500 has fallen 13%, a 60/40 portfolio is down just 4.6%.

The ultimate goal isn’t maximizing returns at any cost, but rather achieving financial objectives with high probability. A diversified approach historically provides more consistent outcomes that support effective planning.

Time horizon is another crucial factor in investment outcomes. Since World War II, there hasn’t been a negative 20-year period for any major asset class or diversified portfolio. This pattern holds true over 10-year periods for many balanced strategies. While past performance doesn’t guarantee future results, this highlights the benefits of long-term investing.

Market stress can create compelling opportunities

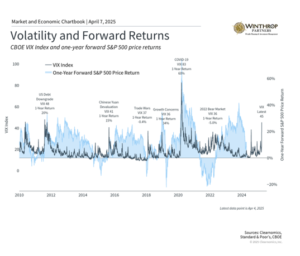

The VIX index, commonly called the market’s “fear gauge,” typically spikes during sharp market declines like those seen in 2008 and 2020. These periods of peak anxiety often feel like they will persist indefinitely to nervous investors.

Looking at subsequent 12-month S&P 500 returns following VIX spikes reveals an interesting pattern. While no single year’s returns can be predicted with certainty, history shows that periods of extreme fear often precede attractive opportunities. This aligns with Warren Buffett’s famous advice to “be fearful when others are greedy, and greedy when others are fearful.”

This pattern is particularly relevant when markets face liquidity rather than fundamental challenges. Liquidity-driven selloffs occur when leveraged investors are forced to reduce positions, potentially creating disconnects between prices and underlying value. These scenarios can offer opportunities for patient investors with longer time horizons.

However, this doesn’t mean investors should try to time markets. Even elevated VIX readings don’t guarantee immediate rebounds. Rather, this supports maintaining a strategic portfolio approach. Market declines often coincide with more attractive valuations, potentially warranting selective additions to positions. Individual portfolio decisions should always reflect specific circumstances.

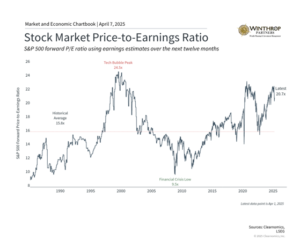

Market conditions have improved valuations

In the current environment, bonds have provided valuable portfolio stabilization as falling rates have offset weakness in other assets. This illustrates bonds’ traditionally lower volatility and tendency to move inversely to stocks – the “zig when stocks zag” effect. This relationship makes bonds valuable portfolio diversifiers during challenging periods.

Recent market action has improved equity valuations following several years of strong returns. While earnings impacts from trade measures remain uncertain, the S&P 500’s price-to-earnings ratio has declined to 20.7x. Technology, Communication Services and Consumer Discretionary sectors have seen particularly notable multiple compression.

Traditional safe haven assets like gold have shown mixed performance recently. While gold reached new highs earlier this year and has generated double-digit returns over 12 months, prices have retreated amid broader commodity weakness. This reinforces the importance of maintaining broad diversification rather than relying on any single asset class.

The bottom line? Successfully navigating market uncertainty requires both defensive positioning and the ability to pursue opportunities. A well-constructed portfolio helps investors manage risk while capitalizing on attractive valuations during periods of market stress. Maintaining this balanced approach remains the most reliable path to achieving long-term financial goals.

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Thomas Saunders is the Managing Partner of Winthrop Partners. Prior to founding Winthrop Partners, Tom was Senior Vice President at what is now JP Morgan. His career includes senior and executive roles at Brown Brothers Harriman and First Niagara Bank, a top 25 Bank. Click here to contact Thomas Saunders about your investment and planning requirements.