Many investors look at past data even though they know the future matters most. Recent economic reports, which show what already happened, have made some investors and government officials worry about the economy. Some people are asking if we might face a recession. Right now, there are signs that jobs are becoming harder to find and prices are still rising, but unemployment is still low and the overall economy is still growing. For people investing for the long term, these mixed signals make it extra important to keep a balanced view.

Looking at economic data is hard, and understanding market factors is never simple. During times like this, it helps to focus less on news headlines and more on the basic health of the economy. A good place to start is by looking at how consumers are doing financially, since consumer spending makes up more than two-thirds of all economic activity and directly affects company profits and the broader economy. How are consumers handling today’s complicated economic situation?

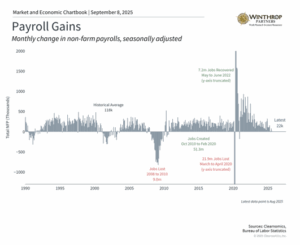

Job opportunities have decreased in recent months

To figure out how consumers are doing financially, it makes sense to look at the job market. The most recent jobs report showed more proof that finding work is getting harder than people expected. According to the Bureau of Labor Statistics, only 22,000 new jobs were created in August, which was much lower than the 75,000 that experts thought would be added. The report also changed the numbers from earlier months, showing that the economy actually lost 13,000 jobs in June, which was the first time jobs decreased since 2020.

While these numbers are important and have been talked about a lot in financial news, economists don’t just look at the main job creation numbers, which can change a lot from month to month. Instead, they look at patterns over time and consider something called “labor market slack.” This basically measures whether people who want to work can find jobs.

Fed Chair Jerome Powell recently said the current job market is in “a curious kind of balance” because both the number of people looking for work and the number of companies wanting to hire have both slowed down.

1

The fact that only 4.3% of people are unemployed is a good sign that most people who want to work can find jobs. The “under-employment” rate, which includes workers who have stopped looking for work, is also still historically low at 8.1%. Other reports show there is still about one job opening for each unemployed person across the country. While this doesn’t mean everyone will find a job, it shows that companies are still hiring.

This matters because, when you combine it with the job creation numbers, it suggests the job market is cooling down slowly rather than falling apart quickly. The important difference is that big jumps in unemployment have historically only happened because of economic shocks, like the 2008 financial crisis or the 2020 pandemic. In contrast, what’s happening now seems to reflect natural changes in the economy. For the Fed (the central bank), this employment trend makes it more likely they will cut interest rates starting in September.

Consumer money situations show strength despite problems

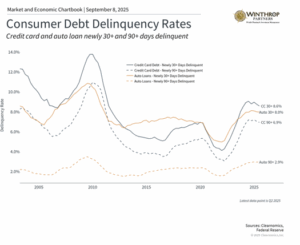

While the job market is getting softer, consumer finances overall are showing signs of a “two-speed economy” – meaning people’s financial situations are different based on things like how much money and wealth they have. Many investors have focused on these numbers because the total amount of debt keeps rising across credit cards, car loans, student loans, and more. When households borrow too much money, it can be a problem if the economy gets worse, which was one factor that helped cause the 2008 financial crisis.

One way to understand if there are problems with household finances is to see whether people are paying their bills on time. The chart above shows that more people have been late on credit card and car loan payments over the past two years. This is partly because people have borrowed more money and, more recently, because interest rates are higher. This increase in late payments has mostly happened among borrowers with lower credit scores, which gives more proof of a two-speed economy.

However, the chart also shows that these late payment rates have leveled off recently and are still much lower than what we saw before 2008. And while the total amount of debt is high across the country, the amount that households are paying on their debt has stayed flat in recent months. This suggests that while some households may feel more stretched as they pay interest and principal on their loans, these numbers are not yet at levels that have historically caused recessions.

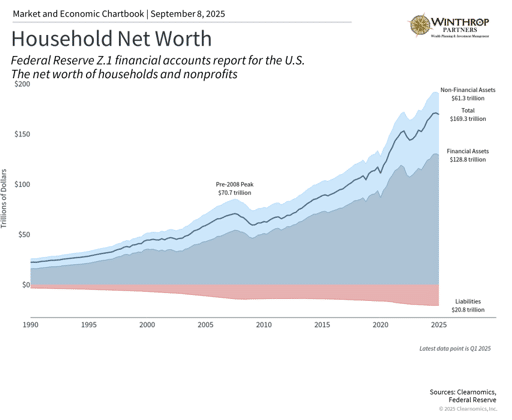

Household wealth remains near record highs

It’s easy to focus only on how much debt consumers have, since this is often where problems start. However, what people own is just as important, and U.S. household net worth (what people own minus what they owe) remains near record levels today. This is shown in the chart above.

At $169 trillion, net worth has grown over the past 15 years because of steady economic growth, rising home prices, and strong stock market returns. Again, this reflects a two-speed economy since the households that have borrowed more money in recent years may not be the same households that are benefiting from rising asset prices. Still, this wealth effect, where rising asset values help support consumer spending, can help provide economic stability. This is one reason why many concerns over the past few years have not always directly led to a weaker economy.

This is also a reminder of what creates wealth over time, and why it’s important to have a portfolio that fits your financial goals. During this period, there were many times when investors worried about recessions. While markets can react to bad news or experience drops in the short run, they often “climb the wall of worry” in the long run. For patient investors, focusing on where the long-term economy is headed is far more important than worrying about where it’s been.

The bottom line? While the job market has slowed down, making it more likely that the Fed will cut interest rates starting in September, it is only one part of the overall economic picture. When the future is uncertain, investors should focus on the underlying economic trends to stay balanced in their portfolios.

- https://www.federalreserve.gov/newsevents/speech/powell20250822a.htm

Brian Werner is a Managing Partner at Winthrop Partners. He has more than 25 years of experience in investments, financial planning, entrepreneurial ventures, corporate finance, and banking. Prior to joining Winthrop Partners, Brian was the First Vice President and a Senior Wealth Advisor for First Niagara, where he led the development of First Niagara’s Western Pennsylvania Private Client Services and served on its western Pennsylvania operating committee. He also held roles with PNC/National City, Greycourt Investment Advisors, and Linnco Future Group, Chicago Board of Trade. Brian is a Chartered Financial Analyst and Certified Financial Planner. He earned his MBA from Duquesne University, Magna Cum Laude.