Recent disagreements between the White House and the Federal Reserve have made people talk more about Fed independence. This happens because there can be natural conflicts between elected officials and the Fed, since they each have different goals and reasons for their decisions.

For example, the President and Congress often want lower interest rates to help the economy grow and make it easier to pay for government spending. But the Fed sometimes needs to make tough decisions about things like inflation and keeping the financial system stable, thinking about what’s best for the long run.

The Fed has critics, and there are many history books that talk about both the good and bad decisions made by different Fed chairs. Still, Fed independence has been an important part of our financial system for many years. Today, much of the talk about this topic focuses on whether the President can legally fire a sitting Fed chair, what would happen if that occurred, and guessing who might be chosen next.

But what really matters for investors is whether monetary policy stays appropriate and the economy stays stable. No matter what the administration decides to do, Jerome Powell’s time as Fed Chair will end by May 2026. What should investors think about regarding the Fed in the coming years?

Fed independence has changed throughout its history

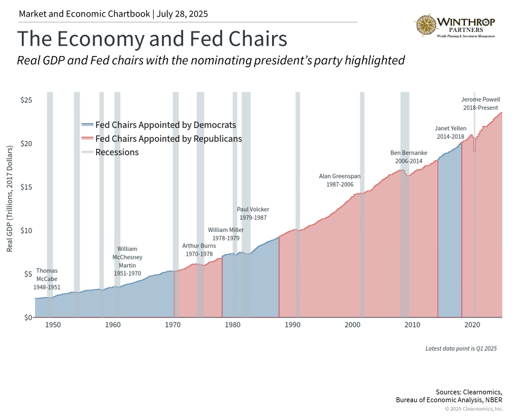

The chart shows the nine Fed chairs chosen since 1948. Almost all of them served under presidents from both parties, including being re-nominated by different presidents. Jerome Powell, for example, was first nominated by President Trump in 2017, and was confirmed for a second term under President Biden. This chart also shows clearly that the economy has grown under different Fed chairs nominated by each party.

The idea of Fed independence is often taken for granted, so it helps to understand its history briefly. As the country’s central bank, the Fed sets monetary policy (decisions about interest rates and money supply) and watches over the stability of the financial system. Independence means the Fed is free from political pressure, allowing it to make decisions based only on what’s best for the economy and financial system.

This independence has developed over time. The Fed was not created by the Constitution, but rather by the Federal Reserve Act of 1913 passed by Congress. The Fed has a dual mandate which has also changed over time, and is often understood as a) keeping unemployment low, and b) keeping inflation at around 2%. So, the way monetary policy works today is influenced by past economic events including recessions and periods of high inflation.

After the Great Depression, the Banking Act of 1935 restructured the Fed, giving more power to the Board of Governors and removing the Treasury Secretary from the Board to reduce political influence. During World War II, the Fed gave up some independence by keeping interest rates low to help pay for the war effort. This continued until the 1951 Treasury-Fed Accord, which is widely seen as re-establishing Fed independence by ending its requirement to support government bond prices.

The inflation and policy environment remains complex

Perhaps the best comparison to today’s situation is the 1970s and early 1980s. Before the 1972 election, President Nixon wanted to make sure that easy monetary policy would support his campaign. Fed Chair Arthur Burns, who had been Nixon’s economic advisor, agreed to this by loosening monetary policy, which economists believe helped cause the inflation problems of the following decade.1

It wasn’t until the early 1980s, under Paul Volcker, that the Fed regained control of inflation by causing a recession. While most economists agree this is what ended the “stagflation” of that period (a time when both inflation and unemployment were high), it came with political challenges. In his memoir, Volcker talked about pressure from the Reagan administration to not raise rates before an election.2

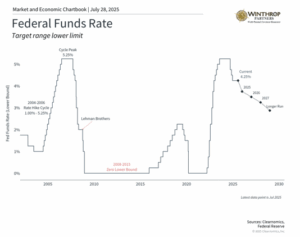

In many ways, today’s economic situation is similar to the 1970s since there are tensions between keeping higher rates to make sure inflation gets better, and lowering rates to help growth. While inflation has been moving closer to the Fed’s 2% target, headline CPI (Consumer Price Index, which measures inflation) is still at 2.7% and core inflation at 2.9% according to the latest report. Also, the Fed is taking a “wait-and-see” approach on whether tariffs will raise prices for consumers.

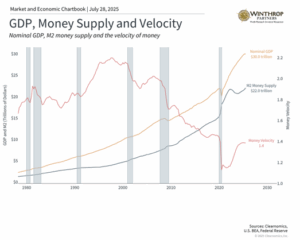

One way to understand this challenge is through the money supply, shown in the chart above. The money supply, which is managed by the Fed, typically increases steadily, supporting both stable growth and inflation. During crisis periods, such as in 2020, the money supply is used to support the economy. However, money supply growth has been flat in recent years as policymakers focused on fighting inflation. Naturally, this can conflict with what some elected officials might prefer.

The Fed is still expected to cut rates

Politics aside, the Fed is expected to cut rates further this year. It has been on hold following several cuts in late 2024 due to uncertainty around tariffs. The reality is that Fed policy exists to support long-term growth trends. When the economy is getting stronger, the Fed’s job is to make sure it doesn’t overheat – sometimes described as “taking the punch bowl away.” When the economy is weak, lower rates may be needed to jumpstart growth.

This balancing act is challenging, even in the best of times. Looking back, the Fed is often accused of being “behind the curve.” For instance, Alan Greenspan, who served as Fed Chair for nearly 20 years, did not properly react to the housing bubble forming at the end of his time in office. More recently, some argue that the Fed raised rates too slowly in 2022 when there was already clear evidence of inflation.

What matters for investors and their portfolios is not to debate what the Fed should or should not have done. Instead, it’s to respond properly to the current investment environment with a long-term plan. History shows that changes in Fed leadership and shifts in policy can create uncertainty, but markets have performed well despite these challenges.

The bottom line? The market and economy have performed well under many different monetary policy and political environments. Maintaining a long-term plan that can navigate this uncertainty is still the best way to achieve financial goals.

- https://www.aeaweb.org/articles?id=10.1257/jep.20.4.177

- Volcker, P. A. (2018). Keeping At It: The Quest for Sound Money and Good Government

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Thomas Bunting is a Financial Advisor at Winthrop Partners. He has more than 50 years of experience in accounting, financial planning, and tax planning. Prior to joining Winthrop Partners, Tom held the roles of partner, managing partner, and senior partner with a mid-sized CPA firm that provided a full range of accounting, tax and financial planning services.

Tom is a member of the American Institute of Certified Public Accountants, the Personal Financial Planning and tax sections of the American Institute of Certified Accountants, and the Pennsylvania Institute of Certified Public Accountants. He was also a former member of the AICPA governing council and a past president of the PICPA. He earned his BS in Accounting from Temple University.