Following extensive legislative deliberations, Congress has enacted and President Trump has signed comprehensive tax and spending legislation on July 4. This sweeping budget measure encompasses numerous provisions, including the permanent extension of Tax Cuts and Jobs Act components, enhanced state and local tax deduction limits, continued estate tax exemption levels, and additional measures. The legislation seeks to balance these tax benefits through targeted spending reductions, particularly in areas like Medicaid.

The significance of this legislation extends beyond trade policy discussions that have dominated recent months, addressing the mounting uncertainty surrounding fiscal policy that has persisted for years. Despite political divisions regarding the budget’s direction, it eliminates the looming “tax cliff” scenario where significant tax policy changes could have occurred upon the expiration of current provisions at year-end.

For individuals, taxation directly influences numerous financial planning considerations, and this bill’s specific measures carry immediate consequences for household budgets. From a broader economic standpoint, investors frequently express concern about government expenditure levels, expanding national debt, and related factors that have influenced market performance over recent decades.

Given these multiple perspectives on the recently enacted budget, what essential information should investors understand regarding their personal financial strategies and the implications for market performance in coming years?

Permanent extension of Tax Cuts and Jobs Act provisions

The recently passed tax legislation, termed the “One Big Beautiful Bill” by the current administration, permanently extends and enhances several critical elements from the 2017 Tax Cuts and Jobs Act (TCJA) that faced expiration. Additionally, it implements new taxpayer benefits that are only partially balanced by spending reductions elsewhere. Several major provisions may significantly impact household finances:

- TCJA tax rates and brackets receive permanent status, eliminating their original 2025 expiration date.

- Standard deduction amounts rise to $15,750 for individual filers and $31,500 for married couples filing jointly in 2025.

- A new $6,000 deduction for eligible seniors (known as a “senior bonus”) phases out for gross incomes above $75,000, with this provision ending in 2028.

- Alternative minimum tax exemption becomes permanent while increasing phaseout thresholds to $500,000 for individual filers, with future inflation indexing.

- Child tax credit expands from $2,000 to $2,200 per child, with inflation adjustments to preserve purchasing power over time.

- State and local tax (SALT) deduction ceiling rises to $40,000 from the previous $10,000 cap, with 1% annual increases through 2029 before reverting to $10,000 in 2030.

- Tip income deduction up to $25,000 annually for workers earning under $150,000, effective through 2028.

- Elimination of certain green energy tax credits, including electric vehicle and residential energy efficiency incentives.

- Federal debt ceiling increases by $5 trillion, removing the need for congressional debt limit debates for an extended period and reducing political uncertainty.

- Business tax incentives expand to promote domestic investment and employment growth.

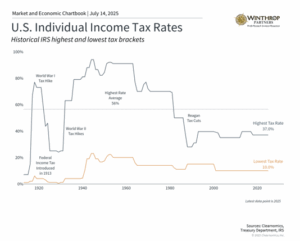

These modifications and others preserve the relatively favorable tax climate that has defined recent decades. The accompanying chart illustrates how current tax rates remain substantially below historical peaks from much of the 20th century, when top marginal rates surpassed 70% and occasionally exceeded 90% during wartime.

Rising fiscal deficit concerns

Tax policy and government deficits represent interconnected fiscal elements, as tax reductions diminish government revenues that must be compensated through either reduced expenditures or increased borrowing. Nevertheless, most government spending supports entitlement and defense programs that face significant political obstacles to modification. Treasury Department data indicates that in 2025, Social Security accounts for 21% of government spending, Medicare represents 14%, National Defense comprises 13%, and interest payments on existing national debt constitute 14%.

Consequently, government borrowing has risen consistently throughout the past century and will likely continue this trajectory. The Congressional Budget Office, a nonpartisan congressional support agency, projects this new tax and spending legislation will contribute $3.4 trillion to national debt over the next decade. This occurs against a federal debt backdrop already exceeding 120% of GDP, totaling $36.2 trillion, which equals approximately $106,000 per American citizen.

Regrettably, this challenge lacks straightforward solutions, particularly given its contentious political nature. Tax reductions can potentially stimulate economic growth, potentially offsetting revenue losses through enhanced economic activity. However, Washington demonstrates a poor history of budget balancing even during strong economic periods. The most recent balanced budgets occurred 25 years ago under the Clinton administration, with the previous occurrence 56 years earlier during the Johnson presidency.

It’s crucial to recognize that income taxation hasn’t always existed in the United States. The contemporary income tax system originated with the 16th Amendment in 1913, initially applying modest rates to relatively few Americans. The system expanded dramatically during the Great Depression and World War II, with top rates reaching 94% by 1944. The postwar era brought various reforms, including President Reagan’s 1986 Tax Reform Act that streamlined the tax code and reduced rates.

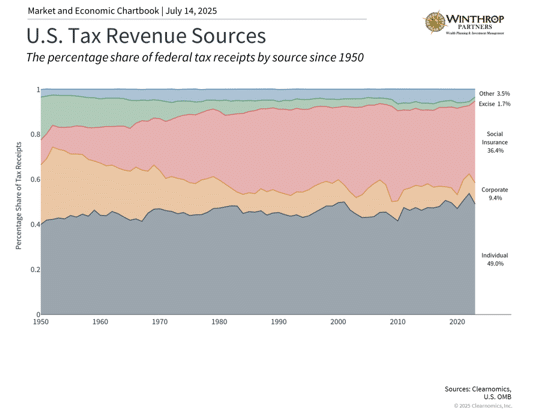

Circumstances have evolved considerably in subsequent years. The accompanying chart demonstrates that individual income taxes now constitute the federal government’s primary revenue source. Social insurance taxes, or payroll taxes, are deducted from wages to fund Social Security, Medicare, unemployment insurance, and similar programs. Other revenue sources represent much smaller proportions, including corporate taxes reduced by the TCJA and excise taxes like tariffs.

For investors, tax policies certainly carry direct implications for financial planning and portfolio management. From a macroeconomic standpoint, however, fiscal impacts remain more constrained. Over extended periods, elevated debt levels can affect interest rates and inflation expectations. While these factors have been relatively high recently, many worst-case scenarios have not materialized. The essential approach for long-term investors involves maintaining diversified portfolios capable of performing across various fiscal and economic conditions, rather than responding solely to policy modifications.

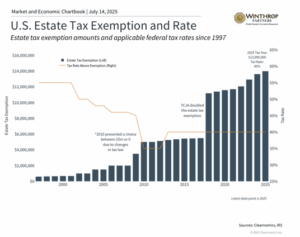

Legislation maintains elevated estate tax exemption thresholds

Among the provisions that would have been central to a tax cliff scenario are estate tax exemptions. The TCJA doubled these thresholds, which were scheduled to return to previous levels this year. However, the new tax bill’s passage makes these higher exemptions permanent while further increasing the threshold to $15 million for individuals and $30 million for couples in 2026.

Although estate taxes may appear to affect only higher net worth households, the reality is that all families must consider asset transfer strategies to future generations. This requires a comprehensive approach integrating estate planning, tax efficiency, philanthropic goals, and long-term family wealth preservation objectives. It’s also essential to remember that individual states may impose estate taxes with exemption thresholds less favorable than federal levels.

The bottom line? The new fiscal legislation perpetuates and expands the current favorable tax environment. For investors, a well-structured financial plan incorporates these tax provisions effectively. Regarding increasing deficits and national debt, it’s crucial to avoid portfolio overreactions while maintaining a long-term investment perspective.

Winthrop Partners is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for informational purposes only and should not be considered investment, legal, or tax advice. All investments carry risks, including the possible loss of principal. No advice or recommendations are being provided in this advertisement, and you should consult a qualified professional before making any financial decisions. Past performance is not indicative of future results.

Thomas Bunting is a Financial Advisor at Winthrop Partners. He has more than 50 years of experience in accounting, financial planning, and tax planning. Prior to joining Winthrop Partners, Tom held the roles of partner, managing partner, and senior partner with a mid-sized CPA firm that provided a full range of accounting, tax and financial planning services.

Tom is a member of the American Institute of Certified Public Accountants, the Personal Financial Planning and tax sections of the American Institute of Certified Accountants, and the Pennsylvania Institute of Certified Public Accountants. He was also a former member of the AICPA governing council and a past president of the PICPA. He earned his BS in Accounting from Temple University.