Social Security is an integral part of the retirement planning process and for many people, it’s a significant form of income that they depend on throughout their retirement years. We anticipate that anybody over the age of 50 will receive full benefits, but as legislation and funding changes, one can only guess what the future of Social Security looks like. This makes it even more important that you know your options and maximize the Social Security benefit as much as possible.

As a financial advisor, my goal is to inform you about your Social Security options and see which decisions would best fit into your long-term goals. In this article, I’ll discuss the 4 best ways to maximize your Social Security payout – guaranteeing the greatest success during your retirement years.

It’s important to maximize those Social Security benefits in any way you can

Here are 4 tips to boost the money you’ve worked so hard to accumulate to use in your golden years.

1. Avoid collecting early

When it comes to collecting your Social Security benefits, your best option is to wait as long as you can, if you can.

Though you can take Social Security as early as age 62, there are costly penalties that you should be aware of.

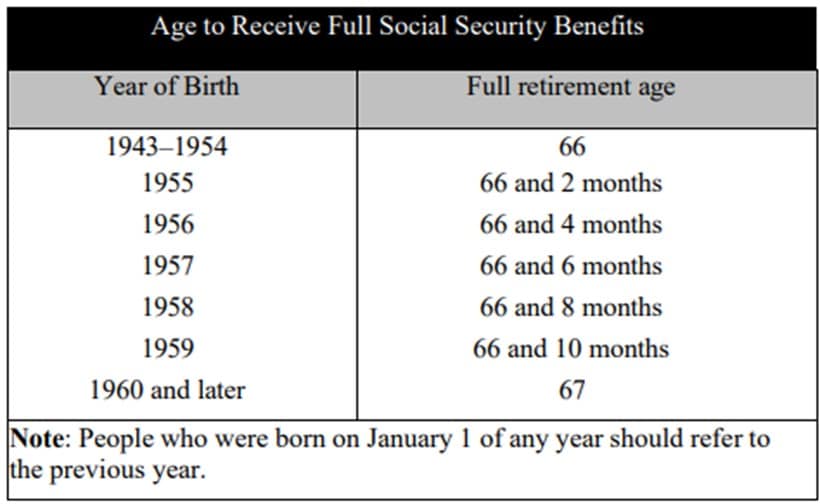

What qualifies as full retirement age based on your year of birth.

Source: Social Security Administration

First, your primary benefit will take a hit – reducing your payment by about 8% per year up until the month you turn 67. If you’re younger than full retirement age during all of 2023 and collect above $21,240, plan on deducting $1.00 from your benefits for each $2 you earn. Once you’ve made about $40,000, your Social Security is wiped out until you reach age 67. These expensive drawbacks tend to successfully deter most people from starting this benefit too early.

2. Work for 35 years (at least!)

Working for 35 full years (or more) is the easiest way to increase your Social Security payments. The government bases the amount of money you receive through Social Security on your earnings – specifically the 35 years you made the most income up until (and not after) the age of 60. They also calculate other factors such as inflation.

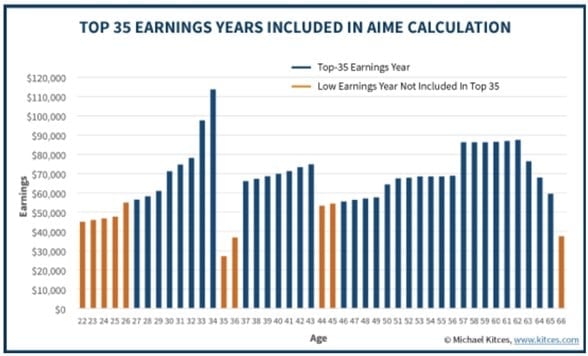

How Social Security factors in the additional years of working into the worker’s

Average Indexed Monthly Earnings (AIME)

Source: Kitces.com

If you enter the workforce late, have large gaps of being unemployed, or have low earnings years, these will count as zeros in your benefit calculation and ultimately result in less money in the end.

However, continuing to work, even in retirement, can increase Social Security benefits. The individual can override earlier years of “zero” or lower earnings with every year of increased earnings after 35 years of age.

3. Consider delaying retirement

More Americans, especially those in good health, are retiring later in life and that isn’t necessarily a bad thing. No matter what their reason, the added income in those later years can dramatically improve your chances of success in retirement. Working even a part-time position can:

- Pad your savings.

- Delay the need to initiate your Social Security or pension income.

- Allow for significant gains to your primary benefit – about 8% a year up to the age of 70.

- Allow you to save more on tax-advantaged vehicles.

Though many prefer not to, it’s good to know you can pull on this option if you need to. It’s important to note that after age 70, there is no advantage to holding out any longer.

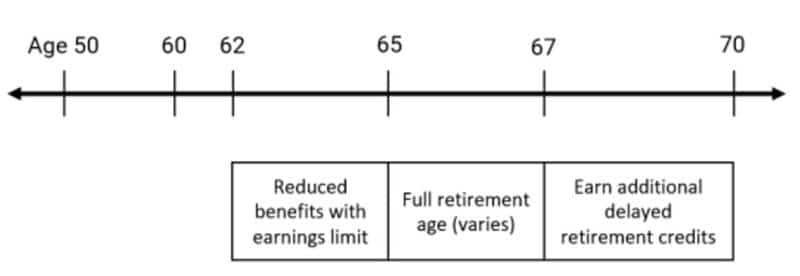

Benefits Eligibility Timeline

Claim age benefit comparison, retirement at 62 vs. 70

Source: AICPA & CIMA

At Winthrop Partners, our planning software can project what you’ll get if you retire early, on time, or at age 70. Using your unique circumstances, we create customized visuals to show your options and see how your choices could affect your retirement plan and long-term goals based on your predicted life expectancy.

4. Make the most out of COLA increases

Did you know that Social Security recipients can increase their benefits without doing anything at all? Since 1975, Social Security’s general benefit increases have been based on increases in the cost of living which is measured by the Consumer Price Index (CPI).

Cost of living adjustments (COLA) are issued by the government and designed to increase monthly Social Security benefits for retirees to keep pace with inflation. For example, last year the COLA increased benefits by 8.7% for approximately 70 million Americans due to the large spike in inflation.

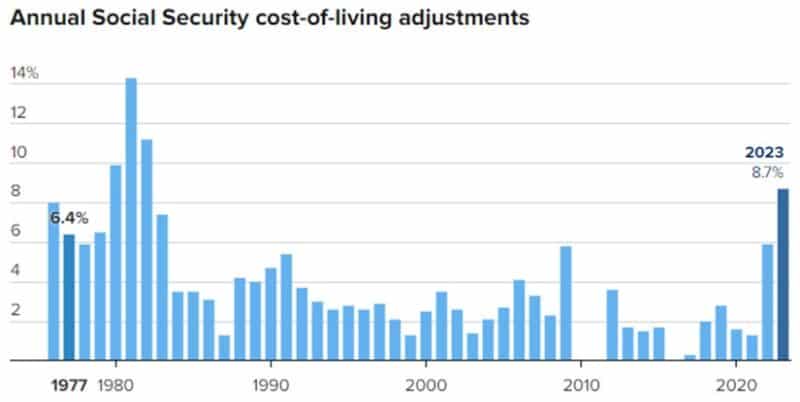

Annual Social Security cost-of-living adjustments since 1977 – 2023.

Source: CNBC

Though COLA isn’t really a bonus, and it doesn’t always match the overall rate of inflation, it does help seniors counter the rising consumer prices while maintaining a standard of living while staying on their predetermined budget.

Is there a way to monitor my Social Security?

Yes, get registered and start tracking your benefit

The first thing you want to do is get familiar with your personal Social Security benefit and stay on top of its progress throughout your earning years. By the age of 40 (and preferably earlier), we recommend going to ssa.gov/account and opening a Social Security account. You’ll be able to look at your annual statement, make sure that you’re getting credited for your earnings, and see what your projected benefit will be. The bar graph provided on the site will show you what your retirement benefit would be if you took it at 62, 63, and so forth through 70. This is a great tool to help you monitor your retirement throughout your planning horizon.

What does the future hold for Social Security?

Since so many working Americans will depend on Social Security for their retirement, I don’t see it disappearing entirely – at least not in the foreseeable future. However, it will grow increasingly hard to fund – especially since there’s a growing discrepancy in the number of retirees to wage earners compared to 10-20 years ago.

Knowing this economic concern, it’s essential for anyone younger than age 50 to consider the real possibility of funding changes for Social Security and how those changes will impact their long-term financial plan.

Most likely Social Security will be funded one way or another. They’ll either keep increasing the full retirement age or increase the ceiling on taxable wages every year. For example, right now up to $160,500 of your wages are subject to Social Security Tax. However, the Build Back Better plan considers taxing those who earn over $400,000. Whatever the case, it’s likely that the government will find a way to get additional tax revenue for the Social Security fund and find a way to postpone taking some of those benefits and avoid taking them away.

Still, many financial advisors are projecting that only 75 – 80% of the current benefits will be available in the future and are designing portfolios that count on that possibility.

Whether you’re in the early stages of retirement planning or age 61 and considering an early retirement, it’s important to be aware of the options Social Security presents. By integrating your Social Security benefit into your retirement plan and creating long term goals, you can better your chances of maximizing its payout for a more successful retirement.

If you have questions about Social Security and how to boost its benefits in your retirement planning process, book a free consultation with Winthrop Partners.

Disclosures:

The views, opinions, and content presented are for informational purposes only. They are not intended to reflect a current or past recommendation; investment, legal, tax, or accounting advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. Nothing presented should be considered to be an offer to provide any product or service in any jurisdiction that would be unlawful under the securities laws of that jurisdiction. All investments involve risk, including the possible loss of some or all of the principal amount invested. Past performance of a security or financial product does not guarantee future results. Investors should consider their investment objectives, risks, and risk tolerances carefully before investing. The Firm has made every attempt to ensure the accuracy and reliability of the information provided, but it cannot be guaranteed. Hyperlinks to third-party websites contain information that may be of interest or use to you. Third-party websites, research, and tools are from sources deemed reliable. The Firm does not guarantee the accuracy or completeness of the information and makes no assurances with respect to results obtained from their use.

Reasons to partner with us when planning your retirement

At Winthrop Partners, we respect our clients, their vision, and the legacy they’re creating. We take pride in developing a strategic process that ensures a seamless transition for our client.

As you start thinking about retirement, download our Social Security Documents Checklist. This tool provides an overview of the Social Security application process and what you’ll need need to make an organized transition.

Thomas Bunting is a Financial Advisor at Winthrop Partners. He has more than 50 years of experience in accounting, financial planning, and tax planning. Prior to joining Winthrop Partners, Tom held the roles of partner, managing partner, and senior partner with a mid-sized CPA firm that provided a full range of accounting, tax and financial planning services.

Tom is a member of the American Institute of Certified Public Accountants, the Personal Financial Planning and tax sections of the American Institute of Certified Accountants, and the Pennsylvania Institute of Certified Public Accountants. He was also a former member of the AICPA governing council and a past president of the PICPA. He earned his BS in Accounting from Temple University.