401(k) Rollover: How to Avoid the 60-Day Tax Trap

Changing jobs or moving into retirement brings a long list of financial decisions. One of the easiest to underestimate is what to do with your 401(k).

For many pre-retirees and retirees we work with in Pittsburgh, Buffalo, and Doylestown, this step feels routine. In reality, it’s one of the most common places we see avoidable tax mistakes. A misunderstanding of the 401(k) rollover 60-day rule can turn a well-intentioned move into a costly problem.

At Winthrop Partners, we’ve seen how a small technical misstep can permanently reduce retirement savings. Knowing how rollovers actually work can help you keep more of what you’ve earned.

What Is the 60-Day Rollover Rule?

If you receive a distribution from your 401(k), the IRS generally requires that money to be deposited into a qualified IRA or another employer plan within 60 days.

Miss that deadline by even one day, and the IRS treats the entire amount as taxable income. If you’re under age 59½, a 10 percent early withdrawal penalty may also apply.

The rule itself isn’t complicated. The risk usually shows up in how the money moves from one account to another. That’s why understanding rollover mechanics matters as much as knowing the deadline.

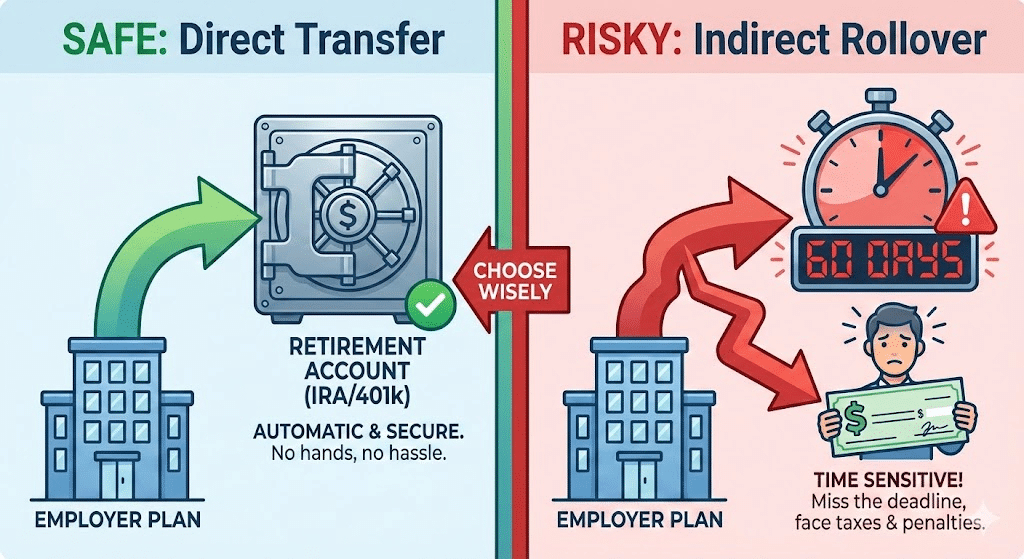

Direct vs. Indirect Rollovers: Same Goal, Very Different Risk

When you leave an employer plan, there are two main ways to move the money. They sound similar, but the difference is significant.

The Direct Rollover, the Safer Route

A direct rollover, sometimes called a trustee-to-trustee transfer, sends your retirement funds straight from your old plan to the new custodian.

How it works:

The check is made payable to the new institution, such as “Schwab FBO Your Name,” rather than to you personally.

Why it matters:

No taxes are withheld, and the 60-day clock never starts because you never take possession of the money.

Our view:

For most situations, this is the cleanest option. It reduces complexity and avoids unnecessary exposure to taxes and penalties.

The Indirect Rollover, the Danger Zone

An indirect rollover occurs when the check is made payable to you.

How it works:

You receive the funds and then have exactly 60 days to redeposit the full amount into a qualified retirement account.

Where problems arise:

If the deadline is missed, even by a single day, the IRS treats the entire distribution as taxable.

That’s only part of the issue.

The 20 Percent Withholding Surprise

Many investors don’t realize that indirect rollovers come with mandatory tax withholding.

When you take possession of the funds, your plan administrator is required to withhold 20 percent of the taxable amount for federal taxes.

How the Math Can Work Against You

Imagine you’re rolling over a $500,000 401(k).

- The plan withholds 20 percent, or $100,000

- You receive $400,000

- To complete the rollover tax-free, you must deposit the full $500,000 into your new IRA within 60 days

That missing $100,000 has to come from your personal savings. While you may recover it later through a tax refund, your cash is tied up in the meantime.

If you can’t replace the withheld amount, the IRS treats it as a taxable distribution. That means ordinary income taxes and potentially a 10 percent penalty if you’re under 59½.

This is why indirect rollovers often create avoidable problems.

How to Execute a Safe Direct Rollover

If you want to avoid dealing with the 401(k) rollover 60-day rule altogether, a direct rollover is usually the simplest approach.

Here’s a practical way to think about the process.

First: Open the New Account

Before contacting your former employer, make sure the destination account is ready.

- Open a rollover IRA or confirm your new employer plan

- Match account types, traditional to traditional or Roth to Roth, to avoid tax issues

If you’re working with a fiduciary advisor, this step is often handled for you.

Then: Request a Direct Rollover

When speaking with the plan administrator, be specific.

- State that you want a direct rollover

- Confirm the check will not be made payable to you

- Provide exact payee and account details

Clear instructions here can prevent

mistakes later.

Finally: Monitor the Transfer

Some plans move funds electronically, while others still mail checks.

If a check arrives at your home, do not endorse or deposit it. Forward it promptly to the new custodian for proper handling.

For additional technical details, the IRS publishes rollover guidance on its website.

When Rolling Over May Not Make Sense: NUA

There is one notable exception to the idea that everything should automatically be rolled into an IRA. That’s Net Unrealized Appreciation, or NUA.

If a significant portion of your 401(k) is invested in your employer’s stock, rolling it into an IRA could eliminate a potential tax benefit.

With an NUA strategy, company shares are distributed in kind to a taxable brokerage account. You pay ordinary income tax only on the original cost basis. The growth is generally taxed later at long-term capital gains rates.

This approach is complex and often applies to long-tenured employees or senior executives. If company stock is involved, it’s worth slowing down and reviewing your options carefully with a tax professional or fiduciary advisor.

Frequently Asked Questions About 401(k) Rollovers

What counts as a valid 401(k) rollover?

A valid rollover is a tax-free transfer between qualified retirement accounts that follows IRS timing rules, including the 60-day requirement when applicable.

Does the 60-day rule apply to Roth conversions?

Yes. If you take possession of funds before converting to a Roth IRA, the 60-day clock applies. Roth conversions are taxable, but when done properly, the conversion itself is not subject to the 10 percent early withdrawal penalty, even if you’re under age 59½. Future withdrawals from a Roth IRA follow separate holding-period and ordering rules.

Can I do more than one rollover per year?

Direct rollovers are not limited. Indirect IRA-to-IRA rollovers are limited to one per 12-month period.

What if I miss the deadline due to an emergency?

The IRS may grant waivers in limited hardship situations, but the process can be time-consuming and costly. Using direct rollovers helps avoid this risk.

How do rollovers affect RMDs?

If you’re required to take a required minimum distribution, that amount must be withdrawn before any rollover. RMDs cannot be rolled over.

Working With a Fiduciary Partner

Moving retirement money is rarely just a paperwork exercise. It’s a moment where small details can have long-lasting consequences, especially when taxes and timing rules are involved. Understanding options like direct rollovers, withholding requirements, and exceptions such as NUA can help you approach the decision with more confidence and fewer surprises.

We work with families and individuals in and around Pittsburgh, Buffalo, and Doylestown (Philadelphia area), as well as clients across the U.S., who are navigating retirement transitions and complex financial decisions. If you’re weighing a rollover or simply want a second opinion on how the rules apply to your situation, a thoughtful conversation can help clarify next steps. You can also explore additional retirement planning insights in our blog to continue learning at your own pace or schedule a consultation.

Brian Werner is a Managing Partner at Winthrop Partners. He has more than 25 years of experience in investments, financial planning, entrepreneurial ventures, corporate finance, and banking. Prior to joining Winthrop Partners, Brian was the First Vice President and a Senior Wealth Advisor for First Niagara, where he led the development of First Niagara’s Western Pennsylvania Private Client Services and served on its western Pennsylvania operating committee. He also held roles with PNC/National City, Greycourt Investment Advisors, and Linnco Future Group, Chicago Board of Trade. Brian is a Chartered Financial Analyst and Certified Financial Planner. He earned his MBA from Duquesne University, Magna Cum Laude.