As an experienced fee only financial advisor, I spend a good amount of time talking to people about their retirement planning. Many questions are similar and most depend on your personal financial situation. There is no magic number or formula, but a good financial plan should answer all your specific retirement planning questions. In this article, I answer the 7 most common questions about retirement planning and explain how to manage them.

JUMP TO

1. When should I start planning for my retirement?

2. How much money do I need to retire?

3. I’m retiring in a few years, should I be reducing my portfolio risk?

4. How do I determine the right mix of assets for my retirement?

5. How can I manage my taxes after I retire?

6. How do I make sure my medical expenses are paid in retirement?

7. When should I claim Social Security?

-

When should I start planning for my retirement?

The Short Answer: It’s never too early or too late to start planning for retirement.

It’s never too soon (or too late) to plan for retirement, however there’s certainly benefits to starting early. The main reason for this is the power of compounding growth. For example, if someone in their early 20’s puts away $500 a month, collecting interest earnings over time can help them retire at 65 with as much as $1,000,000 in their savings.

And then there are people in their 50s and 60s who are just now starting to plan for retirement. You may think it’s pointless to start planning late in the game, but there are actions you can take that will put you in a better position than doing nothing at all. For those 50 or older, you can take advantage of extra contribution opportunities in your 401(k) and your Roth IRA.

Whether you’re early, late, or an old pro at planning your retirement, it’s always a good idea to review your plan, investments, and cash flow to ensure everything is aligned with your goals. As you approach retirement, it’s increasingly important that you start aligning your portfolio with your future cash flow needs while mitigating risk to ensure long term growth.

-

How much money do I need to retire?

The Short Answer: It depends, but it’s important to know, and you need to look at spending and future cash flow requirements to find the answer.

This is the most common (and fear-based question) I’m asked by my clients. Luckily, it’s a relatively easy to sort through if you reflect on these four key areas:

- What are your long-term goals?

It’s important to envision your retirement future and establish the goals you want to achieve once you’re there. Consider factors such as where you want to live, if you want to travel, and if you plan on working to generate extra income in your retirement years. Once you have an idea of how you want to live when you reach financial independence, you can “reverse engineer” a financial strategy that works towards those goals.

- What are you spending currently and is it enough?

Generally, your lifestyle now is a pretty good indicator of how you’ll live in retirement. However, to get a more accurate depiction of your incoming and outgoing expenses, you can use a Budget Planner Worksheet to track your spending. Although your spending will fluctuate slightly from month to month, your worksheet can give a baseline of what retirement expenses might look like. Best of all, if you’re unsatisfied with your current projection, categorizing your spending into needs, wants, and savings can help you adjust those discrepancies.

- Are there any potential deficits?

Once you’ve taken a comprehensive look at your current lifestyle and retirement goals, it’s helpful to add up all your savings and identify potential deficits. Ask yourself these questions when looking at your retirement savings:

– Am I maxing out my contributions or can I contribute more to these accounts?

– Are my portfolio allocations still aligned with my risk tolerance and within your retirement timeline and overall goals.

– What fixed income can I rely on in retirement?

Be sure to include the earnings collected through Social Security, pension plans, sources of income, types of investments, and annuities. Generally, you’re going to want to replace about 70% of your pre-retirement income through Social Security, retirement savings, and other investments. Then, explore the ways you can maximize your savings by reducing costs in other ways:

– Which sources of income can I tap into first, and what are the tax ramifications?

– Will I take Social Security right away or could I wait to maximize its benefits?

– Do I take a lump sum from my pension or annuitize it?

- Consider your health and longevity

Determine how long your “nest egg” will need to sustain you. For example, if you have a long family history of people living past 100, the traditional 30-year timeline may fall short – especially if you plan on retiring early. Talk to your advisor about your options and always shoot for longer to avoid outliving your savings.

There are a lot of important (and permanent) decisions that need to be made in a small window of time when it comes to retirement cash flow planning. Establishing a good financial plan can help you perfectly piece the puzzle together – creating less stress and making the most of your retirement income.

-

I’m retiring in a few years, should I be reducing my portfolio risk?

The Short Answer: Maybe not.

When you first start saving for retirement it’s easier to take on more investment risk. As you near retirement, the time to rebound from market fluctuations may not be in your favor and it may seem more practical to shift into a more conservative portfolio. Unfortunately, as our clients inch closer to retirement, we often see them moving the needle a little too far in the direction of an ultra-conservative asset allocation.

Though it’s important to ensure your nest egg is there when you need it, growth is still necessary to cover your day-to-day needs and protect against inflation. Even if you’re 60 years old and planning on retiring at 65, you still need to plan for a 25+ year retirement. Retirement cash flow planning occurs over a long-term horizon and even if you are just a few years away from retirement, you’ll need to plan and invest accordingly.

Reviewing a strategy that you can stick with through the inescapable ups and downs of the market, and reevaluating the risk you’re willing to take are difficult decisions. However, making those tough calls sooner may help you avoid the biggest risk of all, which is not reaching your financial goals.

-

How do I determine the right mix of assets for my retirement?

The short answer: Consider your appetite for risk when deciding.

There is no cookie-cutter approach to retirement planning. All too often we see an advisor suggest a 60% equity/40% fixed income portfolio as the right asset allocation for retirement, but there are many more factors that come into play when determining an appropriate asset mix.

When determining how to diversify your assets it’s important to establish your personal risk appetite by considering factors like your:

- Time horizon

- Current income and expenses

- Family situation

- Personal goals

- Current net worth

- Future income expectations

At Winthrop Partners, we know risk appetite is personal. Think about how you reacted to past market downturns – did it keep you up at night or were you confident that the markets would come back (as they have in the past)?

At Winthrop, we take a basic evaluation of your risk profile and use it as a starting point for the planning process. We include questions like:

- What is the minimum amount of investment risk I need to achieve my retirement cash flow goals?

- How can I ensure I have adequate cash flow in the event of a market downturn without having to sell my investments?

- Where is the cash flow coming from in my portfolio?

- What is the probability that I outlive my investment?

For most wealth managers this is where the risk process ends, but we use your initial profile as a basis for asset allocation, which is checked, re-checked, and confirmed. Though a certain amount of risk must be taken to help achieve your goals, we avoid unnecessary risk and consider your financial needs to ensure that your money works for you and is there when you need it.

-

How can I manage my taxes after I retire?

The Short Answer: A withdrawal strategy can help reduce your tax liability in retirement.

Considering taxes ahead of your retirement is important to the success of your long-term financial goals. By planning, you can come up with a strategic plan to lighten your tax burden and in turn, maximize your income in your retirement years. To start, it’s important to learn about how your different withdrawals and income may be taxed overtime. These income sources can include investments, retirement accounts, Social Security, pension plans, and annuities.

Creating a withdrawal strategy with a trusted advisor is a good way to ensure that money is gradually being set aside for your yearly tax bill. A withdrawal strategy organizes different income sources and considers their varying tax treatment, managing them in a way that minimizes tax payouts, and maximizes earnings. By leveraging ongoing tax opportunities such as Roth Conversions, tax loss harvesting, and charitable giving, we use our expertise and creativity to keep your money working for you in retirement.

-

How do I make sure my medical expenses are paid in retirement?

The Short Answer: An HSA account is a tax-efficient way to pay for medical costs.

Healthcare is one of the biggest expenses to account for in retirement. A study from the Employee Benefit Research Institute found that a couple could need as much as $360,000 saved by the age of 65 to cover their healthcare expenses during retirement.

One option we recommend to our clients is to consider investing in a Health Savings Account (HSA). An HSA works like a retirement 401(k), but the money after 65 can be withdrawn without penalty and tax-free to pay for qualified medical expenses. The plan also comes with incentives such as tax-deductible contributions, tax-free withdrawals for medical expenses, and tax-deferred growth on your investments.

I also remind my clients that though they can qualify to receive Medicare at 65, it’s important to understand what it does and doesn’t cover. If the plan falls short of your needs, it could end up becoming costly. Though there are options to purchase added insurance to strengthen the plan, it’s important to weigh your options and see what will benefit your unique situation best.

-

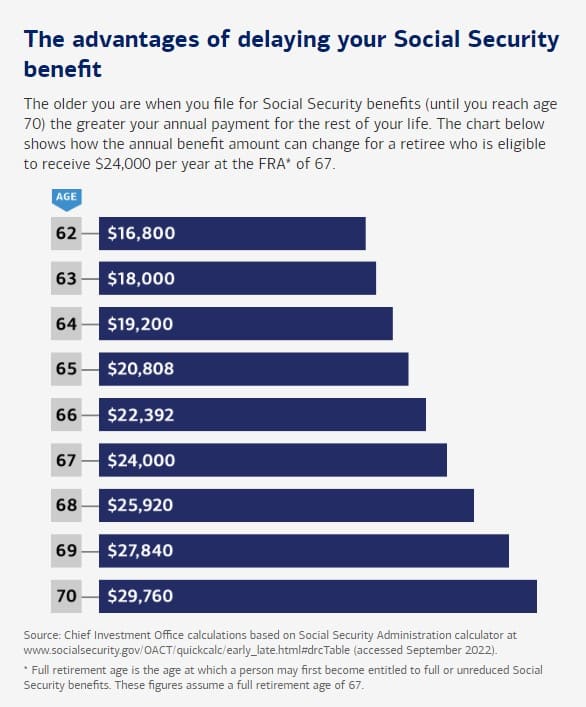

When should I claim Social Security?

The Short Answer: As close to age 70 as possible if you want to maximize your Social Security benefit.

For many people, the best option is to wait until your full retirement age or 67 (or beyond) to redeem Social Security benefits. You can claim as early as 62, but you will be penalized by receiving a reduced benefit, costing you and your spouse more in the long-term. If you wait until you’re 70, you could substantially increase the payment you receive for the rest of your life. After age 70, there is no incentive to wait.

Since there are so many factors that play a role in when you decide to claim Social Security, it’s different for everyone. Consider these questions as you evaluate your individual strategy:

- When are you planning to retire?

- What will your earnings look like if you continue to work past the age of 62?

- What other sources of income will you have in retirement?

- How long do you expect to live?

- What does your family situation look like?

Retirement planning can be scary which makes it all the more important to ask the questions early and make sure you get the answers you need to make the right choices for your financial future.

Book a call with one of our trusted advisors to learn more about retirement planning and how to secure a fiscally sound future.

Disclosures:

The views, opinions, and content presented are for informational purposes only. They are not intended to reflect a current or past recommendation; investment, legal, tax, or accounting advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. Nothing presented should be considered to be an offer to provide any product or service in any jurisdiction that would be unlawful under the securities laws of that jurisdiction. All investments involve risk, including the possible loss of some or all of the principal amount invested. Past performance of a security or financial product does not guarantee future results. Investors should consider their investment objectives, risks, and risk tolerances carefully before investing. The Firm has made every attempt to ensure the accuracy and reliability of the information provided, but it cannot be guaranteed.

Brian Werner is a Managing Partner at Winthrop Partners. He has more than 25 years of experience in investments, financial planning, entrepreneurial ventures, corporate finance, and banking. Prior to joining Winthrop Partners, Brian was the First Vice President and a Senior Wealth Advisor for First Niagara, where he led the development of First Niagara’s Western Pennsylvania Private Client Services and served on its western Pennsylvania operating committee. He also held roles with PNC/National City, Greycourt Investment Advisors, and Linnco Future Group, Chicago Board of Trade. Brian is a Chartered Financial Analyst and Certified Financial Planner. He earned his MBA from Duquesne University, Magna Cum Laude.