Comfort Zone

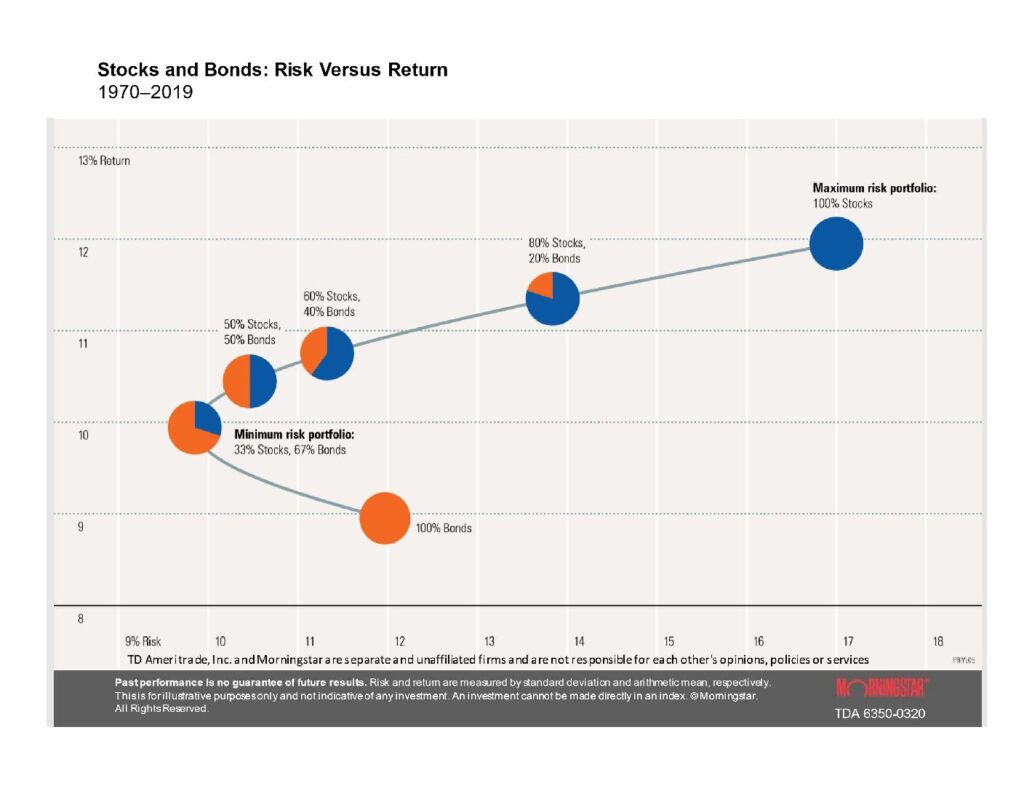

Every Client, whether the client is an individual, family, partnership, trust or company, has a comfort zone that resides at an intersection of risk (as measured by volatility ) and return.

Every Client, whether the client is an individual, family, partnership, trust or company, has a comfort zone that resides at an intersection of risk (as measured by volatility ) and return.

We invest a great deal of time and deploy sophisticated methodologies including behavior finance techniques to properly understand the types of risk our clients are willing to take. Just as importantly we try to minimize the risks that they actually need to take in order to achieve their financial goals.

By understanding our clients’ goals, their time horizons and their risk tolerance we can create flexible, client-friendly financial plans that help the clients achieve their goals with a minimum of risk. Most importantly we stand beside our clients during the plan’s implementation to monitor progress and make adjustments as personal and economic circumstances change.